5 cost-effective ways to automate payments and billing in your business

Key takeaways

Adopt a robust payment solution: Advanced payment solutions can automate your billing processes, reducing manual admin associated with sending payment reminders or entering credit card numbers. This allows accounting professionals to focus more on their core services.

Support automated clearing house (ACH) or direct debit: Offering payment options such as ACH or direct debit could reduce costs, because these typically have lower fees than credit cards.

Monitor payment reports: Keeping an eye on payment reports can provide valuable insights. For example, knowing when a client's credit card is about to expire can help prevent missed or defaulted payments, ensuring smoother cash flow for your firm.

Your business can't survive (let alone thrive) if you're unable to get bills paid in a timely manner. That’s why streamlining payments and billing should be a top priority.

One way to accomplish this is through automation. By putting tedious billing and accounting tasks on autopilot, you can free up time to focus on core business activities that drive profitability.

In this article, we'll share five tips for automating payments and billing in an efficient, secure and cost-effective manner. We’ll cover how to:

Get your business and banking fundamentals in order.

Adopt the right payment solutions.

Free up valuable time and get paid on schedule.

Potentially reduce your costs by supporting ACH or direct debit.

Keep an eye on your payment reports.

1. Get your business and banking fundamentals in order

To manage payments and billing effectively, you need to have the right infrastructure. This starts with setting up a valid business bank account, says Jennie Moore, Partnerships Marketing Manager (AMER) at Ignition.

“When you're accepting payments on behalf of a business, you need to make sure you're properly incorporated and you have a proper business account,” she says.

In addition to verifying your business's financial information, you must also do the same with your clients. Before proceeding with a client agreement, ensure their payment or banking details are valid, so you can bill them with ease.

"Ensuring that the payment method works is one of the first things businesses should do when starting a client relationship,” says Joshua Lance, also Head of Accounting (AMER) at Ignition.

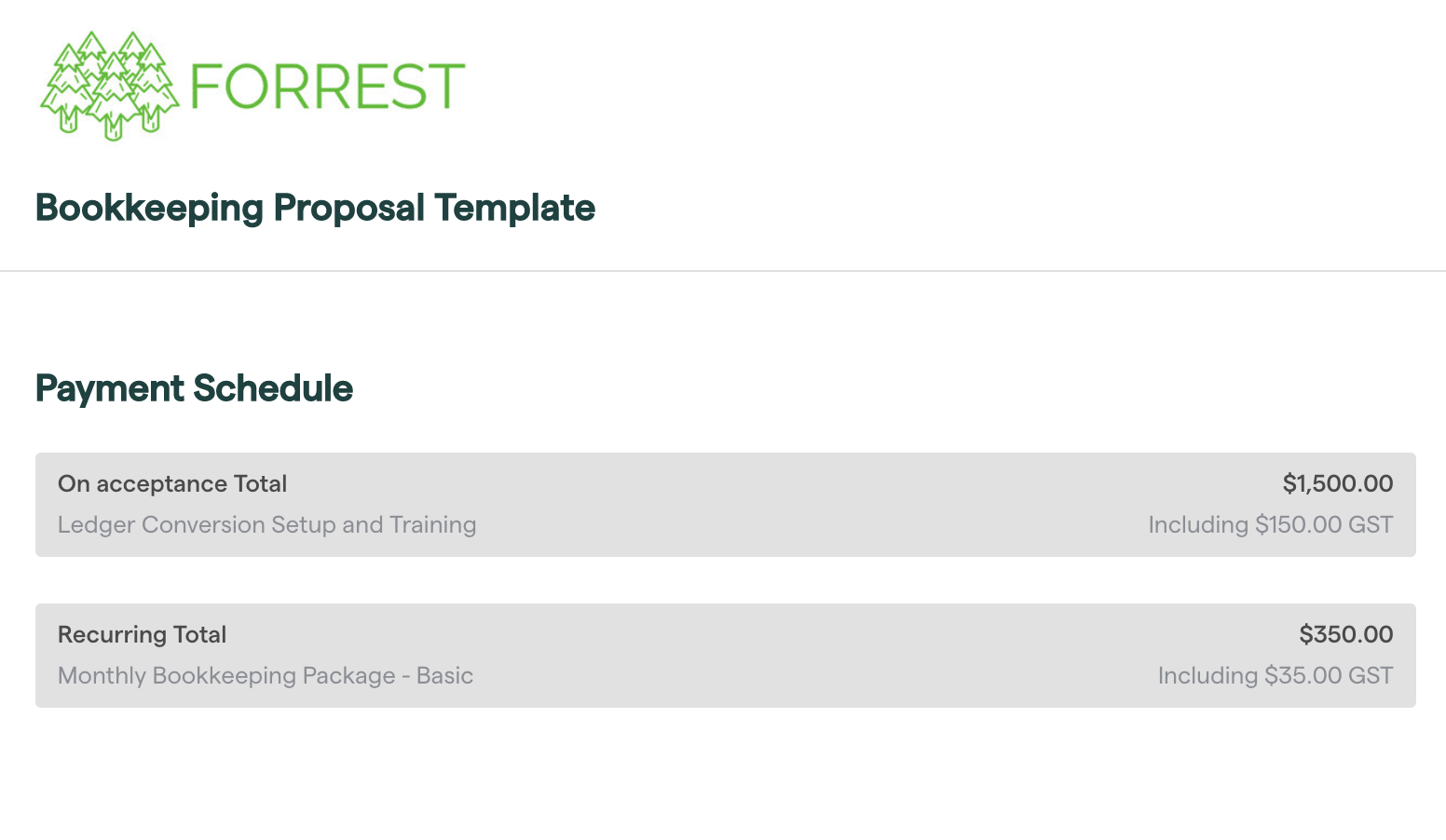

“A lot of times, we recommend collecting a deposit or upfront fee in a proposal and then doing a project-based or monthly recurring payments system [like a subscription] after that.”

He says the goal is to get the invoice paid as you do the work and “not have to be a collections agent to get the payment.”

Fortunately, doing that’s easy when you have the right payment processor or software, which brings us to the next tip…

2. Adopt the right payment solutions

Acquiring new business.

Providing top-notch services.

So, if you're an accountant, you should devote more energy to providing financial services rather than on tasks such as sending payment reminders or entering credit card numbers.

Similarly, if you’re a digital marketing agency, your time is better spent on providing services such as search engine optimization (SEO) or content marketing, rather than on manual invoice processing.

This is why having a robust payment solution is key. Ignition, for instance, has client payments features that allow you to collect payment details upfront and automate payment collection from the moment a client signs your proposal. When the invoice is due, the platform automatically takes the payment so neither you or your client has to lift a finger.

As Joshua Lance puts it, “If the client accepts your proposal, they can input their credit card information, and sign the engagement, all in one spot.”

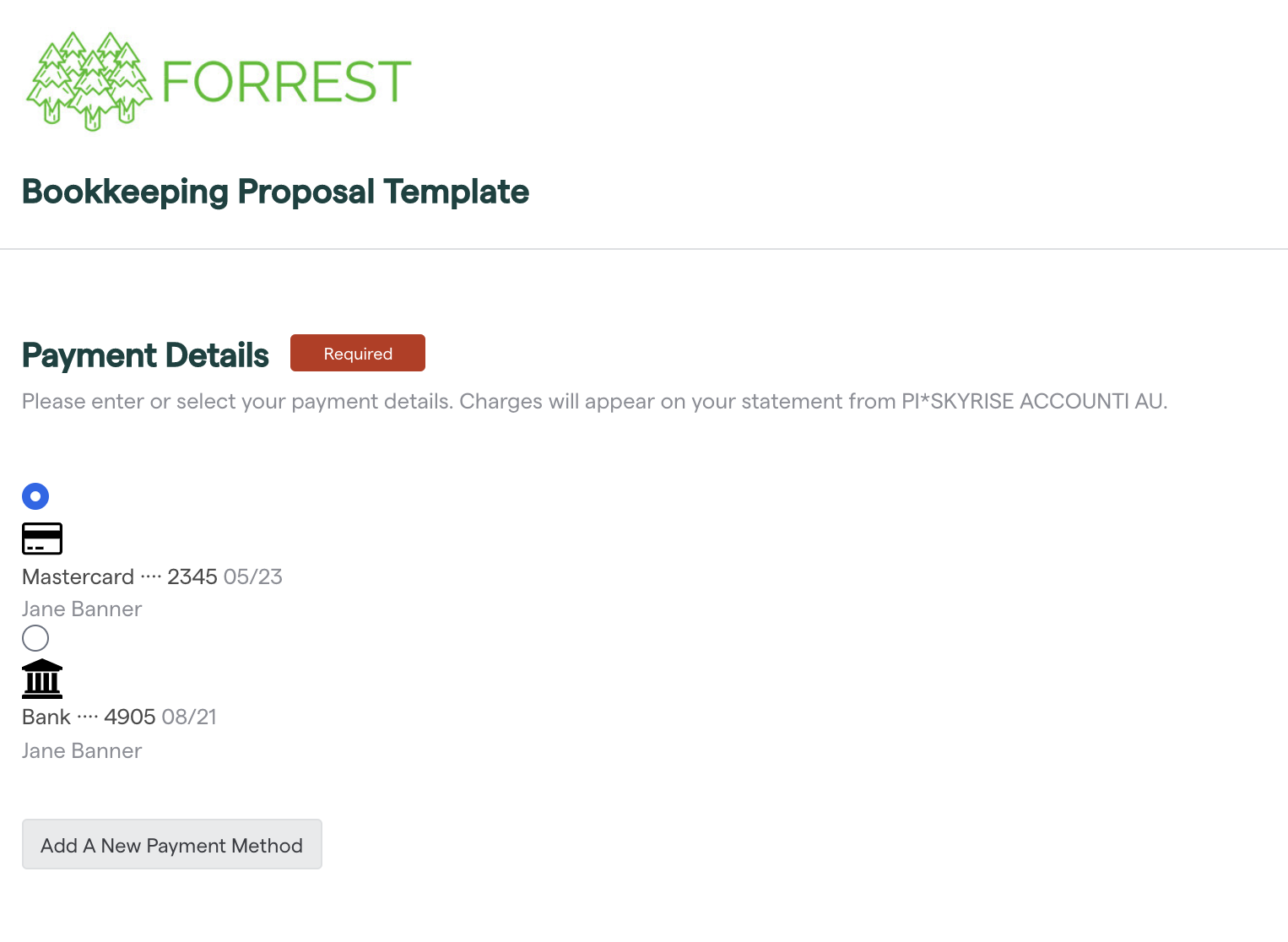

The right software can also reduce liabilities for your business. According to Jennie Moore, solutions such as Ignition can protect customer or client data (including their account number), so you stay compliant and limit risk.

“Clients can put in their information online through a form, and that confidential data is blind to us,” she says. “Perhaps we'd be able to see the last four digits of their card, but the rest stays private. This provides both parties with more transparency, control, and trust.”

3. Free up valuable time and get paid on schedule

Having to pay processing fees is a common worry that entrepreneurs have about accepting payments such as credit cards and automated clearing house (ACH).

Although this is a valid concern, it's worth recognizing that modern invoices and payment systems can actually save you money in the long run.

“The way I look at it is, I would spend more of my billable time chasing down a check [without the right payment solutions],” says Jennie Moore. She says the amount of work involved with a manual payment system outweighs the disadvantages of accepting payment methods such as credit cards, ACH, or direct debit.

Joshua Lance offers a similar sentiment, adding that modern payment processors pave the way for streamlined client billing. A good platform lets you automate billing and payment collection – and accept recurring credit card payments – which means you always get paid on schedule.

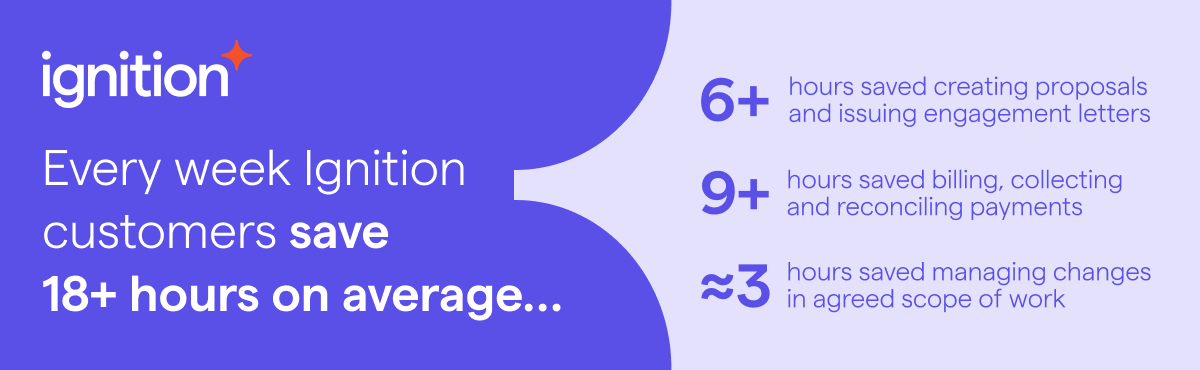

Businesses that want to streamline their payment collection can do so by partnering with a provider such as Ignition. Ignition customers save on average over nine hours per week billing, invoicing, collecting and reconciling payments.

4. Potentially reduce costs by supporting ACH or direct debit

Want to lower costs? Offer payment options such as ACH, debit cards, or a direct debit payment method. Although fees will vary across different payment processors, ACH and direct debit costs are typically much lower than those of credit cards.

Note that at Ignition, ACH payment processing costs are capped. Unlike credit cards, which come with variable percentage costs, ACH transactions have more predictable fees that don't increase as much when you're processing larger amounts.

5. Keep an eye on your payment reports

Having access to payment reports allows you to uncover actionable insights that can help streamline your operations and save money.

One example would be paying attention to credit cards or debit cards that are about to expire. When you have reports that automatically surface this information, you can proactively update the cards you have on file and prevent missed or default payments.

This is something that Ignition does really well, says Jennie Moore. “The software lets the practice owner know that something's about to expire so the issue can be followed up in the proper amount of time, giving them lots of lead time to have the new data and have the new credentials added by the customer.”

Over to you

It's not always easy to talk about money, payments, and billing with clients, but these discussions are critical to ensuring that you’re compensated for your services. It's also important to adopt a platform such as Ignition, which can simplify client billing in your business.

Watch a demo of Ignition and discover how our platform can take your business to the next level.