How to price advisory services and engage your clients

When you’re introducing advisory, top of mind is how to price these services. This article shows why value-based pricing is so effective and offers tips for presenting pricing to clients, and how to use Ignition's three-tier structure to position your pricing effectively.

Why value-based pricing works for advisory services

The goal of pricing strategies is to ensure a profitable margin for services that have consistent demand. Fortunately, there are several models that can help achieve this aim. In this article on How to Manage Rising Costs and Price Services as an Accountant, we explore various pricing models that can be used. But of all these approaches, Josh Lance, the Head of Accounting (AMER) at Ignition and Managing Director at Lance CPA Group, considers value pricing is best for advisory services. He says by using it, accountants and tax professionals can have fewer clients while ultimately taking on more work. This is because with value-based pricing you’re paid for the value you add to clients’ businesses, which eliminates the need for acquiring as many clients.

By adopting this pricing strategy for advisory, you can avoid the need to frantically chase after clients just to keep your practice viable. “It’s not a race to get 1,000 tax clients or 2,000 clients in the firm to make. Instead, it’s reducing the amount of clients that you have, being able to provide more value and get paid for that value as a result, which ultimately introduces that benefit,” says Josh Lance.

Adopting this pricing model also translates into reduced stress levels, because you can work regular hours during the tax season instead of constantly being on the go. This ultimately leads to a more positive outcome, not just in terms of the bottom line, but also in terms of employee satisfaction and customer experience.

How do you know how much to charge for advisory services?

The decision of how to price your advisory services is closely related to determining how much to charge for them. Sean M. Duncan, CPA, who runs SMD Consulting & Accounting in North Dallas, says there's no ‘right’ price since it can differ from one company to another. While you can ask other accountants or clients about how much they charge, it's all about trial and error, due to the many factors involved in determining your prices.

Tips for clearly communicating your pricing to clients

No matter how much you charge or how you structure your fees, it's important to clearly explain the specific factors that were used to determine the price. Hourly pricing offers clients a unit metric, without any clear indication of how much time or effort will be required to complete the task. So, it tends to lack clarity and fails to provide clients with a clear understanding of what they can expect for their investment.

When you’re presenting pricing to a client, it's important to be clear about what’s being priced, why certain tasks are priced a certain way, and the pricing schedule, which may include recurring charges, one-time fees, hourly rates, retainers, and estimates. Your pricing should provide the total investment for the proposed period of time.

How to use a three-tier pricing structure to boost transparency and sales

Implementing a three-tier pricing structure can be an effective way to clearly communicate pricing options to clients. This approach typically involves offering a bronze tier for basic services, a silver tier for basic services plus some advisory ones, and a gold tier for a more comprehensive, concierge-like experience. Unlike hourly pricing, which can lead to uncertainty and confusion, tiered pricing provides transparency and has become a popular choice among businesses. In fact, using this pricing model can even bolster sales efforts, as clients are able to choose from up to three proposals that best meet their needs. You can use this feature in Ignition to accelerate your sales process.

Communicating the benefits of automation to your clients does pay off

If you’re an hourly biller or use a type of time-based billing in your firm, the idea of automation being directly linked to successful price increases may seem counterintuitive. After all, if you automate a task, surely it makes things quicker and therefore you bill less as a result.

But there are definite advantages to automation. According to the research report Where Opportunity Meeting Value: Business Model Trends for Accounting Advisory Services by CPA.com, firms that communicate the advantages of automation to clients are almost 3.5 times more likely to succeed in raising their prices.

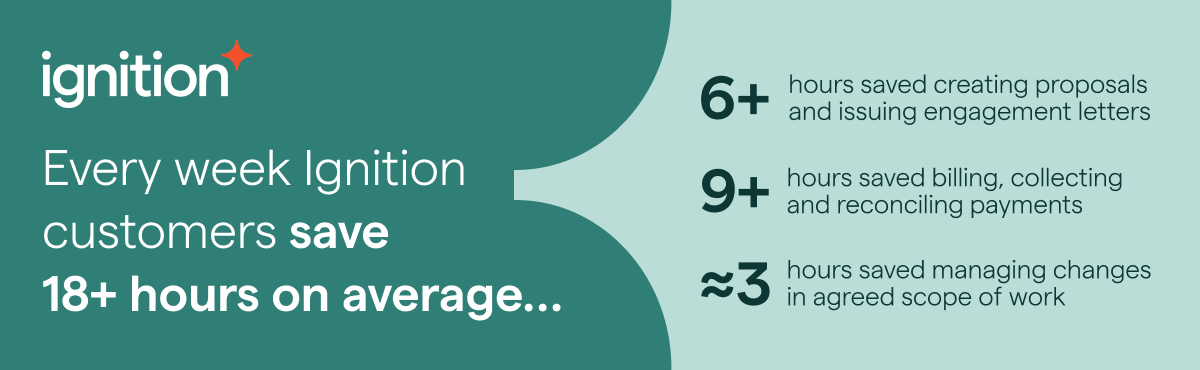

By automating manual tasks, firms can also free up time for more advisory work. This not only enables them to be more proactive with their clients, but also respond to their needs more efficiently. To achieve this, automation software like Ignition can be immensely helpful. As Josh Lance points out, firms have limited time and cannot always hire new staff. Due to being swamped with basic tasks, many firms find it difficult to provide advisory services without the aid of automation.

“One of the things with advisory that firms stumble on is that advisory is still being done at the partner level or senior level in the practice,” says Josh Lance. Consequently, partners or senior staff members have a multitude of obligations to fulfill. He says firms often struggle to provide advisory services due to the constraints of managing the practice, clients, and people. This can result in limited availability for more advisory work.

It can be more efficient and effective to provide advisory services within your firm if you train your staff to do so. According to Josh Lance, this approach reduces the dependence on partners and allows people within the firm to take greater ownership of the process.

How to engage your clients

How you’re pricing your advisory services and what you’re charging for these should all be outlined in your engagement letter. Engagement letters define the business contract between your business and your client. It outlines the fee structure, responsibilities and obligations of your firm and your client. It should detail the advisory services that you’re expected to provide and how frequently you will provide them.

Related article: Getting started with engagements letters in the United States

While the engagement is a vital step in onboarding new clients, it’s a process that shouldn’t be confined to the beginning of a relationship. To continue to build strong and transparent relationships, it pays to implement a system of regular re-engagement, repricing, and rescoping that happens at least once a year.

A regular re-engagement process not only creates an opportunity for you to assess your current advisory services and fees, it’s an ideal opportunity to discuss with your clients changes in their business or situation, which may require a need for different or additional advisory services. It’s one more way that you can continue to build your client relationships and at the same time increase your service revenue and manage your scope.

Why should you use an engagement letter?

If you undertake new work without a signed engagement you run the risk of not getting paid for unapproved work. You also create a situation where you and your clients' understanding of advisory services can become misaligned, potentially leading to a dispute.

With Ignition, your engagement letter or contract terms form part of your proposal to save you time. You can get a head start using the platform’s legally vetted, industry standard terms, or by uploading your own. You can even access engagement letter templates from selected accounting industry bodies. This helps prevent errors and reduce admin.Accept payment on your proposals upfront, using Ignition

Of course, you want to make sure you get paid for your work and don’t waste time chasing payments. In Ignition, the payment process is streamlined by enabling you to collect credit card or ACH information upfront in your proposals. This removes the need to follow-up with clients, so you can focus on providing a quality service.

With Ignition, the payment process can also be automated. For instance, if you agree to provide monthly accounting services to a client for $1,000 per month and they provide their payment information, you can invoice and receive payment without having to do any extra work at your end as a result.

The advantages of offering monthly subscription fees for advisory services, particularly for Client Accounting Services (CAS) like Virtual CFO, are explained in this article about Moving Your Practice to Year-Round Recurring Revenue.Over to you

Ignition makes offering new services to your clients fast and easy, with proposal templates created by leading industry experts and industry-vetted engagement letter templates, to help get you up and running in no time. Unlock next level efficiency in your practice with automated client billing and payments. Watch our online demo today to see how you can save time and money with Ignition.