Introducing more ways for clients to pay

In an industry prone to bad debt, getting paid has been a long-standing challenge for accounting professionals globally.

As Rebecca Mihalic, Director of businessDEPOT, reflected in her recent blog, accountants can protect their business from trade credit troubles by conducting due diligence on a new client, having detailed engagements in place and taking payment details upfront wherever possible.

At Ignition, we’ve always recommended industry best practice is to secure pre-approval for payments for engaged services when your client first signs your proposal. That way payment happens automatically without you or your client ever having to worry about it. However, we recognize that not every client can commit to pre-approved payments, and that practices need more payment flexibility, especially for services priced on completion.

More payments flexibility for you and your clients

Common uses cases for Review and Pay

While using Review and Pay to get paid will be driven largely by your firm and clients’ requirements, this new online payment experience is ideal for:

Clients with an Accounts Payable approval process: if your client requires all payments to go through a formal AP approval process, giving them the option to review and easily pay an invoice online is a win-win situation. This is quite common in not-for-profit organizations or large, multinational businesses that have more stringent payment processes for an agreed scope of work.

Clients who did not commit to pre-approved payments on your proposal: if your client is new to your firm and wants to establish trust before committing to automatic payments, Review and Pay is a great entry point to start benefiting from payments automation. It also gives you the option to get paid more easily if your firm isn’t quite ready to start using digital payments with your clients.

Services priced upon completion: if your client engages you for services that are priced on completion but hasn’t pre-approved payment, Review and Pay is a great way to collect payments if your client wants to review the invoice once you have completed the work.

What this means for getting paid using Ignition

The launch of Review and Pay means you can now manage payments for all client engagements within Ignition - all in one place. You won't need to use multiple payment platforms as you'll have two options to streamline your payments process and get paid more easily once your client has accepted your proposal in Ignition:

Pre-approved payments: your client will be charged automatically on the invoice due date. Simply collect your client’s payment details upfront and secure pre-approval for payments as part of your proposal.

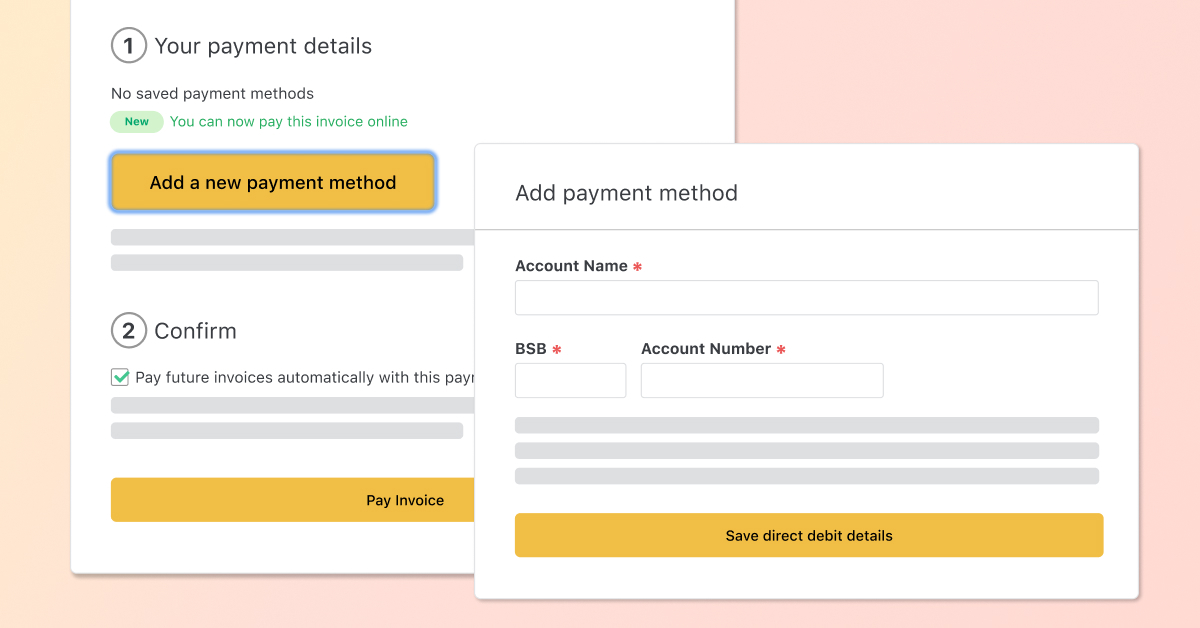

Review and Pay: your client will have the option to review your invoice first and pay online via our secure online payment page. Simply share an online payment link directly with your client, or enable online payments to show a ‘Pay Invoice’ button on invoice emails by default (if your accounting software is connected to Ignition).

Importantly, you choose whether to use pre-approved payments or give your client the option to review and pay - or offer a combination of both. It’s all part of our commitment to make clients at the heart of your business as we continue to evolve our platform to add value at every stage of your client relationship.

Learn more about Review and Pay here.Proposal to paid, in one place! See Ignition in action.