Investment strategies for firm growth

Discover effective growth strategies for accounting firms, featuring insights from industry leaders, as well as how Ignition can help streamline implementation.

Key takeaways

- By organizing teams by niche, accounting firms can offer tailored, industry-specific advice and services, improving the client experience.

- Delegating tasks to the right team members or outside experts, such as SEO or marketing specialists, allows leadership to focus on strategic decisions and higher-level work, driving growth.

- Investing in people by allocating resources to hire or train individuals in roles that directly contribute to the firm's objectives ensures that each team member adds value and drives success.

- Acquisitive growth opportunities can allow for quick expansion and integration of new clients and expertise.

- Offering services at three distinct pricing levels can meet diverse client needs and budgets, encouraging clients to select the level that best suits their requirements while allowing for flexibility, and providing an opportunity for you to upsell services.

Growing your firm isn't just about doing more of the same. It's about mixing it up, getting smart with your services and your pricing, and making sure every part of your business is pulling its weight.

In this blog, you’ll get real-life insights about accounting firm growth from industry experts Marcus Dillon and Dan Gertrudes.

Plus, we'll show you how revenue generation platforms such as Ignition, can make these strategies a breeze to implement, helping your firm run smoother, keep clients happier, and open up new revenue opportunities.

Optimizing team structure and client segmentation

For Marcus Dillon, CPA and President of Dillon Business Advisors (DBA), one of the investments for success has been how the firm has structured its team, and that goes hand in hand with client segmentation.

“At DBA, we work with a podlike structure; each pod is led by a client CFO. Those client CFOs have client controllers that work with them, and each of those client controllers has client service managers,” he says. “It's a nice, smaller org chart within each pod than you would have overall across the organization… That's allowed us to segment our clients based on industry vertical.”

So, for example, you might have a veterinary pod, a dental pod, or a medical pod. “That team structure and that segmentation allows us to serve those clients really well,” Marcus Dillon says. “It’s been very helpful, making sure the client knows who their service team is and who they can go to for complete service.”

The way it works at DBA is pretty simple. If it's a payroll or bookkeeping issue, clients go directly to their client service manager. If it's for tax or tax strategy, they go to their client controller. If it's for business strategy, cash flow planning, or advisory services, they go to their client CFO.

For DBA, this team-of-three approach has really helped narrow the focus where it's necessary. “That client service manager is really only aware of the 20 to 30 clients they may be serving,” Marcus Dillon says.

“They're not pulled into just-in-time consulting or putting out fires in another part of the business… What we want to do as leadership is make sure that as those fires do come up within client segments, only the right people are brought into those, while the rest of the team continues to work and deliver exceptional client service.”

Leveraging industry-specific expertise

From a revenue standpoint, this approach allows you to map out how much “revenue carry” a team can have, then you can plan margins for the owner or for leadership to be able to see how much client capacity this team has. Then you also know how much profit each additional client to that team would bring. “That's why we view it more as an investment – because we have poured into that team around industry expertise,” says Marcus Dillon.

“So, with some of the nuances that go along with, say, dental accounting or vet accounting, we make sure that those team members are up to speed on those different strategies, whether it's tax-related strategy or just how the accounting is laid out [within that industry] so the client is best-served.”

He continues: “All of that produces ROI; we've got a more profitable engagement, because everybody knows what they can work on and what they're supposed to be working on. You don't have somebody at client CFO level doing something that a CSM could be doing. You’re saving those dollars and saving that time.”

Delegation as an investment strategy

Another of DBA’s investment strategies for firm growth? Delegation – being able to delegate to others who can do things better than you can. For example, Firm Administrator Rachel Dillon works directly with DBA’s contracted SEO expert. “That frees me up not to think about that, so I can provide advisory to clients and continue refining DBA,” says Marcus Dillon.

Investing in people

It’s also about investing in people being in the right roles, Marcus Dillon says. If, for example, you've identified that you need a certain position – whether it’s an operations manager or a marketing person – then you can allocate budget to that, either immediately or over time, to get the right person.

And perhaps the right person is an external contractor. “We don't want to downplay using outside consultants or contractors by any means; those are typically a faster return on that investment, because they have immediate bandwidth to help the firm, and they usually have experience because they work with others doing that role,” says Marcus Dillon.

“A lot of it just comes back to: we invest in people,” he says. “Anytime you invest in people, you have to do the hard work first, build out the structure of where those people are going to sit, and determine what success looks like in investing in that person.”

Organic firm growth

Dan Gertrudes, CEO and Founder of GrowthLab Financial Services, has taken a two-fold high-level approach to firm growth: organic growth and acquisitive growth. On the organic side, it comes down to two things for him. First, like Marcus Dillon, he believes in investing in people. “We don't buy machines. We don't amortize machines,” he says. “We hire and train and develop team members and try to target a three-month break-even cash flow.”

Also for organic growth, GrowthLab prioritizes digital marketing, with the focus on:

- Inbound marketing.

- Outbound sales through cold email campaigns and inside sales.

- Referrals.

Strategic acquisitions

This two-pronged approach has worked well for GrowthLabs, though it can ebb and flow with seasonality and what’s going on in the industry. “For example, during the Great Resignation, hiring slowed down, so therefore we had to intentionally pull back on revenue growth,” Dan Gertrudes says.

“So, during that time, we shifted to acquiring three firms, one of which was more of an acquihire – hiring somebody that has a book of business and then being able to bring in their team and their revenues – a kill-two-birds-with-one-stone kind of thing.”

As for investment strategies that didn’t work for GrowthLabs? “I would lean less towards what didn't work and more towards, ‘when the iron is hot, lean in; when it's not, be agile’,” says Dan Gertrudes. “That's the pivot: It’s more about redirecting resources and management attention.”

SEO strategy

Marcus Dillon also invests in search engine optimization (SEO) to ensure DBA’s polished online presence reaches their ideal clients. Likewise, the firm tries to make sure that it answers all the questions it can for prospects or clients when they come to DBA’s website.

“Some of those questions are very specific, such as, ‘Who do we work with?’ And we try to answer that,” says Marcus Dillon. “That way, a prospect or potential referral partner can self-select if they're going to be a fit [with us] or not.”

Similarly, when DBA puts pricing on its website, the prospect can opt in or opt out. “They can essentially start selling themselves on why they need our services or they can move on to the next website,” he says. “So, we try to be polarizing when it comes to [who we work with]; we either want somebody that's a yes or a no – not somebody that's sitting on the fence too long.”

Innovative pricing

What’s more, DBA has also made the switch to a three-tiered pricing system, a feature that revenue generation platforms like Ignition enable. “Essential, Premier, and Elite are our core packages for CAS [Client Accounting Services], and we accept clients only in one of those offerings now,” says Marcus Dillon. “We have some legacy clients who we've gradually moved over, but any new client has to choose one of those three.”

Marcus Dillon sees people gravitating to the middle package. “It’s human nature,” he says.

Thus, for clients who opt for DBA’s Premier package, that means a quarterly touchpoint with their client CFO. The Essential package offers an annual touchpoint – “so it's a long gap when you have a conversation with your CFO only once a year,” he says. The Elite package, then, is a monthly touchpoint with their CFO. “We allow people to move up or down throughout their relationship, based on what's going on in their business – that’s really what should drive that.”

If they’re proactive, most businesses at least want the quarterly package, he says, because they can review trends and the Client CFO can make recommendations to keep their business progressing towards its financial goals.

“And now, our average price point across all clients is a little bit above that middle package – a total client relationship of around $2,120, $2,150-ish, which is above the $2,000 entry point for the middle package,” he says. “It just goes to show that most people are coming in at that middle tier and then either adding on some additional services or moving up to Elite sometime throughout the year and then maybe scaling back.”

Ignition’s add-on feature also helps you cross-sell services in a subtle, unobtrusive way. Clients are able to self-select services you suggest that complement those in each tier, helping to generate more revenue and improve your profitability.

Invest in automation technology for firm growth

Ignition streamlines how accounting and tax firms can implement these growth strategies by automating manual tasks, such as client billing, client payments, and proposal creation and management. With customizable templates, it also simplifies drafting tailored proposals, enabling firms to focus on higher-value tasks and growing the business.

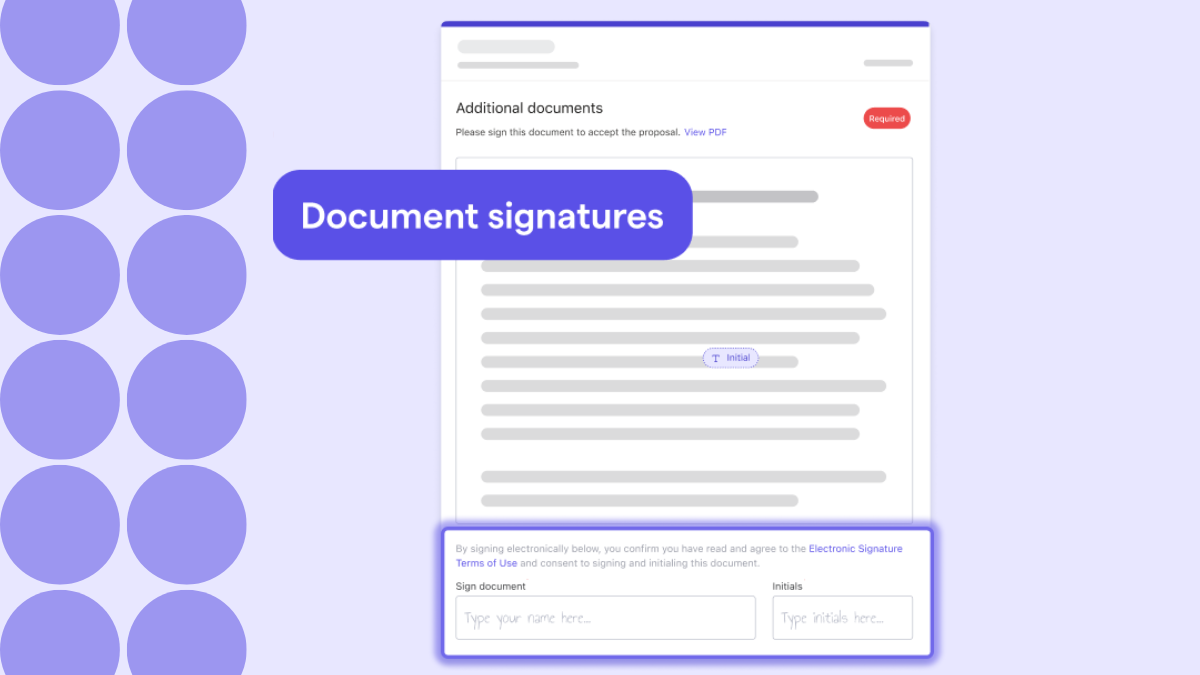

With Ignition’s engagement letters, you can clearly list all of the services you provide, and edit those services as the client relationship grows and changes. Plus, Ignition supports the three-tiered pricing system and enables you to upsell services, making it easier for firms to cater to diverse client needs.

Fuelling sustainability and efficiency

Whether you're spicing up your service offerings, being more choosy about your clients, upskilling your team, or using other tactics to grow your firm, Ignition empowers you to navigate these complexities with ease. The platform enhances client experiences, optimizes processes, and helps firms to drive revenue and profitability. Want to learn more? Watch an instant demo.