Lessons Learned on the Cloud Journey with Brandon Cumby, CPA

The following is a first hand account of how one invalidated file of Quickbooks Desktop and thousands of dollars in write-offs led to a complete firm transformation out of the 1980’s.

This interview features excerpts from a webinar with Ryan Embree of Ignition & Brandon Cumby former Director of Consulting at a mid-sized US firm, and current Senior Account Manager at Xero. You can watch the interview in full here.

Ryan: Just to get started, can you tell me about your role at the firm?

Brandon: I worked there twice, actually.

I was a Senior Accountant, doing a lot of manual work for our bigger and higher revenue clients, and it was also my first time working in a local public accounting firm. I was surprised at how much manual process and procedure there was. I did some business development there as well, and I ended up bringing in a high-value consulting project, as well as some fraud investigation, etc.

It was this experience that led me to my experience with accounting information systems. I left and did AIS/ERP implementations for about 2 years, but the split was amicable and we stayed in touch. It was during this time that I had an opportunity to learn from accounting industry legends Ed Kless and Ron Baker, and I went down the rabbit hole of discovering that there were others out there - Rod Drury, Rob Nixon, Guy Pearson, Jason Blumer, etc. - who wanted to shake up the traditional accounting firm model.

I went back to work there as Director of Consulting, as the primary goal was to bring in consulting and advisory work, but I quickly found that we did not have the proper base to build from which to build. In hindsight, the Director of Operations would have been a much better descriptor of what I actually did. So, I took my experience, a mountain of books, my network of advisors, and got to work trying to re-engineer the firm workflows, processes, and tools we were using.

“I just knew we had to make these tasks more automated and process driven - which would then make the business scalable, repeatable, and ultimately, more profitable, but the key driver was to make this smooth so we could spend our time on growing the business.”

Ryan: What type of problems were you facing at the firm?

Brandon: What weren’t we facing!

- We didn’t have a proper sales function. We didn’t capture leads and start marketing to them, we didn’t track our close rates, our quote/proposal process was completely one-off and manual. We essentially wrote a bespoke engagement letter for every client in MS Word, which took lots of time. Because of this, we didn’t understand a pipeline of new business, so forecasting wasn’t really available to us internally either.

- Admin tasks were confused and slow. Billing took forever, and write-offs were a monthly chore.

- Pricing, pricing, pricing - it was all wrong. We did a lot of fixed fee work, but we often wrote off work, but we didn’t know why? Was it technology hiccups, was it the client, was it an employee issue - no way to know except by gut feel.

- Technology - we took the “bring your own software” approach, but honestly, we had 17 different flavors of QB Desktop in the firm, which meant lots of back and forth with the client, and slow delivery times on work.

- Reporting - because our inconsistent bookkeeping approach, reporting was a nightmare. It ended up being a cobbled together from Word and Excel after we dumped it out of the accounting systems. I just knew we had to make these tasks more automated and process driven - which would then make the business scalable, repeatable, and ultimately, more profitable, but the key driver was to make this smooth so we could spend our time on growing the business - whether through new client acquisition or by offering new services, such as consulting and advisory, to our existing client base.

Ryan: How did you go about converting to cloud systems? What triggered the change?

Brandon: See above. There was one defining moment though - we had this big client that would inconsistently show up with records wanting a compiled financial because their bank needed it. So, we took their QBD Accountant’s Copy, loaded it, and proceeded to do 4 months of bank and credit card recon, all by brute force method. It took days, due to the volume, complexity, and, let’s be nice, “client errors.”

When we got done and sent the Accountant’s Copy back, they had invalidated the changes. We wrote off thousands of dollars of work, and I HAD TO REDO IT. I was done. I swore never again.

Once I dipped my toe into the cloud products, I found this whole new world. We could do time & billing, quote to engagement, reporting, bank feeds, receipt capture, document retrieval, and dashboarding - and it is all available real-time, in a highly collaborative environment - all you need is an internet connection. I knew this was the path out of the 1980s!

I demo’d virtually anything and everything. I also knew the most critical solution I had to solve for was General Ledger. Where did we want to keep the single source of truth? I did a test drive of QBO, Sage Live, Intacct, and Xero. I put them all into a matrix and did a whiteboard session where I made very clear all of the pros, cons, upsides, and drawbacks, including cost, support, functionality, integrations, etc. I landed on Xero. It made the most sense to me and I could clearly see the time savings, which meant better realization.

We can get into it later, but a properly trained bookkeeper in Xero saves 25-50% of the time it took in desktop, and then another 10-15% over other cloud products because you don’t have to code and reconcile - it’s one step. It just made a ton of sense to me. And as a CPA, I absolutely loved the inbuilt controls and audit trail.

“Handle the people and process before you address anything else. We went technology first, and the people and processes second.”

Ryan: Looking back what were some mistakes you made?

Brandon: We made a lot of them.

- We weren't honest about the cadence of change we could digest, collectively. I’m acutely aware of the notion that too slow and nothing changes and too fast and things come apart. What I was not aware of is that comfort zone in between those extremes is different for every person. So, it is helpful to have really emotionally honest conversations about where each person involved falls on the spectrum. There are no wrong answers.

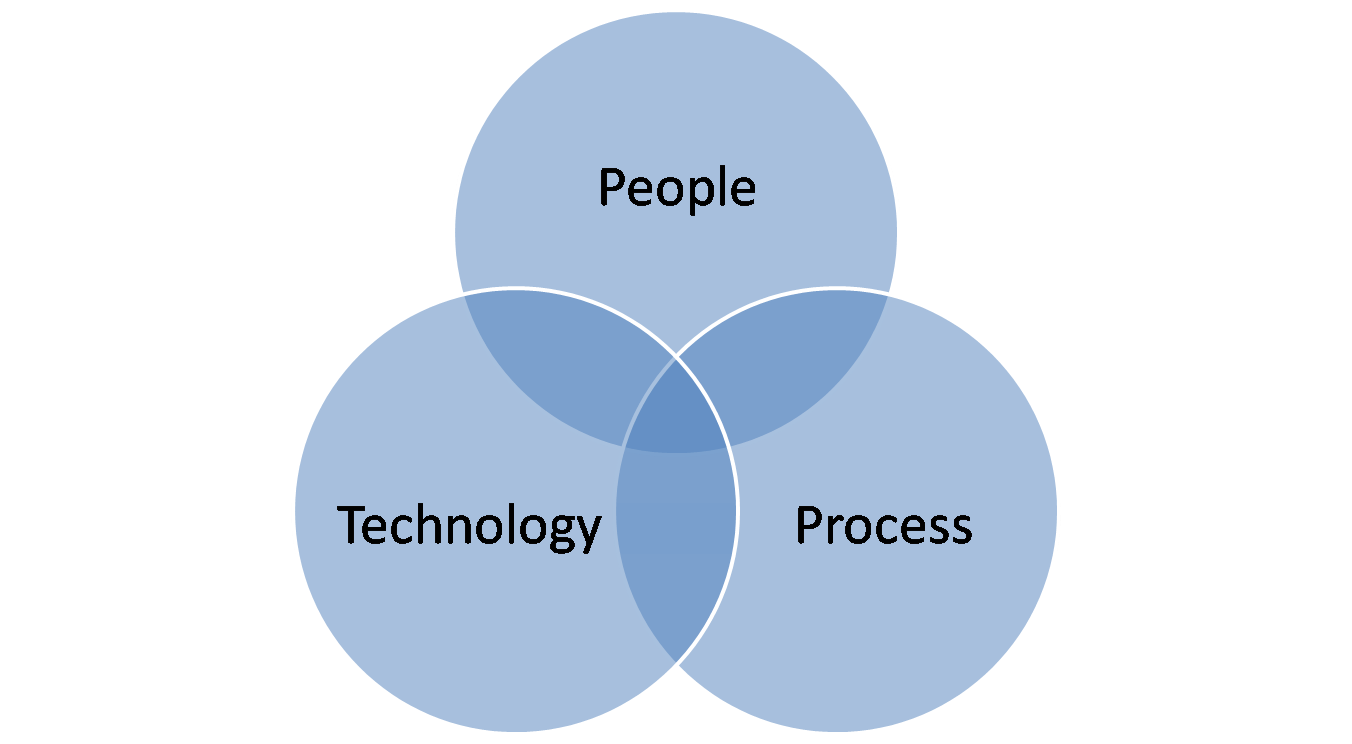

- Handle the people and process before you address anything else. We went technology first, and the people and processes second. A lot of issues we found that appeared technology related were actually confused or broken processes or a human resource issue.

- Commit. I heartily recommend a book called “The Answer to How is Yes” by Peter Block. We spent a lot of time doing the “Well, maybe, what if…” After we had started to make changes. So, I would recommend plan, plan, plan before you start to make changes, but then once you start - be fully committed.

Ryan: How did you segment your client base?

Brandon: We broke the clients into three, really four buckets.

We had those clients who rarely/never touched their GL. They gave us data, we did the accounting work, and they got deliverables at a prescribed cadence - monthly, quarterly, annually.

The next wave was clients who were open to technology, especially those clients who had complained about how manual some tasks were or how much time it took us to turnaround work.

The next group was a little more hesitant. Expect resistance here, but don’t worry, you just need to make the case as to how you will be able to provide more value, better, faster, etc. They will get onboard.

The last group - officially labeled by behavioral psychologists as “laggards” - they would still be using a rotary dial phone if it would work. They won’t change on THEIR end, but you can always make their work more profitable.

Example: We had a client who used to bring in boxes of receipts, and it was fairly hopeless we could stop the behavior. So, our choices were either to find efficiency on our end or price it accordingly. We decided that a modest price increase, and automating the work internally was the best blend. We would pour those receipts onto a table and take pictures of them, upload them into Xero, later Receipt Bank, and make the work of preparing financials about 3 times faster because we weren’t manually processing ALL of that paper!

We looked at past billings, write-offs, and collections very intensely. We also segmented the clients by service line - where did we get our revenue? Was it tax, monthly client accounting services, consulting, IRS rep work, where?

What we found is we could do a lot better with our AR. We knew we had to solve that. That’s where Ignition appeared on our radar, and it turned out that it also solved some other non-financial problems as well.

We also saw that tax was a bigger portion of the business than it felt like, and we didn’t necessarily like that because it is not Monthly Recurring Revenue.

We also saw very quickly that profitability varied wildly from client to client, and sometimes job to job! That was surprising at first, but then it made sense, WE weren’t doing things in a systematic, consistent fashion, so we couldn’t expect to get a predictable margin from every job, client, or service line. It quickly popped out as a problem to solve.

Ryan: What did you do with the bad clients?

Brandon: Hmmm, bad clients. I have an unpopular opinion on this. I believe a firm, whether it be an accounting firm, shipping conglomerate, or a lawn service, they should identify and seek to either 1) reform or 2) replace bad clients. That’s just my take, and the jury is split about 50/50 on this, honestly.

What we did though - we did our best to remove all the inefficiencies from their work to make the margins fatter, and we took a hard stance on collections to get the AR in line. We worked with them to explain our new processes and trained them best we could. We didn’t fire anyone during my tenure and no one left. Subsequently, some of the lower tier clients have either left or been terminated. None of those were for reasons necessarily due to the changes, but “bad clients” like to be messy, disorganized, mercurial, etc. - they don’t like to fit into process and procedure - so it is not like it wasn’t for the best.

My snarky answer to “what did we do with the bad clients?” We replaced them with good ones. ;-)

Ryan: How did you make bookkeeping more profitable at your firm?

Brandon: Automation and standardization. Ignition was the big front end piece of this.

By standardizing the lead to quote to engagement workflow, and also capturing payment data upfront before we started work, we knocked down a BUNCH of problems, immediately. It took a lot of time to build the standard monthly client rates and “menu of services” so to speak, but once we did, we could predictably and reliably sell these services and know where we would land in gross margin, and how much time it would take us.

Xero was the linchpin of the automation - we connected bank and credit card feeds for our clients, set up bank rules, used cash coding, and also connected 3rd party apps like Hubdoc to retrieve bank and credit card statements for us, just for those small minority of transactions that were not routine or to snag check images for those clients still writing a lot of checks - sidebar, it’s 2018 and I haven’t owned a checkbook in almost 10 years, who does this?

I checked in with the firm just yesterday - in an annual look back, they figure they have gutted 40-50% of the time it took previously to earn the same or greater revenue.

That’s the crazy part to me - because not only do you save time and make things faster, more accurate, etc. - clients will pay more for it! Insane.

Ryan: Can you discuss how the firm expands their service offerings by offering Advisory services? Let’s pretend we don’t offer them yet, how do you recommend introducing advisory services? What needs to be in place?

Brandon: First off, let’s demystify the word “advisory” services. In my practical application, advisory and consulting are completely fungible.

What it is not: Interpreting IRS code is not advisory, neither is the latest tax avoidance scheme, and neither is quoting Rev Proc pronouncements. It is not suggesting

What it is: I look at it simply and holistically - Advisory is a process or a set of processes and tools to provide systematic, periodic and relevant advice to a client that adds value to their business.

Examples: Budgeting and Planning sessions, led by the Accounting firm. Forecasting and business coaching, Quarterly business reviews, the creation of KPIs and dashboard, look back look forward analysis, cashflow modeling, and/or tracking non-financial statistical data and using it to explain and predict operational and financial performance.

Before you start layering in complex and/or specialized advisory services, you have to make sure the basic recording and reporting of the financial data is the least burdensome and least time-consuming thing you do for the client, as it is also the least valuable. You have to right size that task, first. If you find there is still a lot of manual time-consuming work, look for a solution. It is out there. It might be as simple as getting the client to make some changes, it might be staff, it might be technology. Find it.

The absolutely easiest foray into advisory is offering Quarterly Business Reviews - all you do is meet with a client and explain their results in non-accountant speak, and make suggestions for what to improve, ideas to consider, etc. It sounds easy, but it is terrifying for a lot of accountants because you have to take a step or two outside of the rote work.

Another is Budgeting and Forecasting - if your client has specific business goals for the next quarter, year, decade, etc. - they need this in their business! They don’t know it, but they do.

Imagine for a moment if you could help a client increase their margins and bottom line, and you could charge $1K for this service, once a year, based on your client base, how much in annual revenue would this mean for your firm? $150K, $250K?

What’s great is there are off the shelf tools to do ALL of this! Fathom is absolutely wonderful for building out the dashboards, reports, etc. for the Quarterly Business Reviews. It takes a few clicks to spit out beautiful and very easy to understand reports from their financial data.

Xero has in-built budgeting tools, and there are easy to use forecasting products out there if you don’t want to build your own. In the old days, pulling all this together would take hours or days, now it is quick and easy because data is very close to real-time and these products talk to each other!

Ryan: This has been great, unfortunately we're out of time. Thank you so much. If people are interested in hearing more about your experiences or learning more about Xero is there a way they can contact you?

Absolutely, if anyone wants to chat 1v1 with me about my experience I'd be more than happy to connect. You can email me at: brandon.cumby@xero.com