Must-read webinar recap on selling accounting and tax services

Key takeaways

- Expert panel discussion: Gain insights from industry leaders Kristen Keats, Andy Smith, Anne Napolitano, and Luke Templin, moderated by Ignition's Matt Kanas, on effective sales strategies for accounting and tax services.

- Sales techniques explored: Learn about various sales approaches, including how to communicate value to clients, the importance of understanding client needs, and tailoring solutions to specific problems.

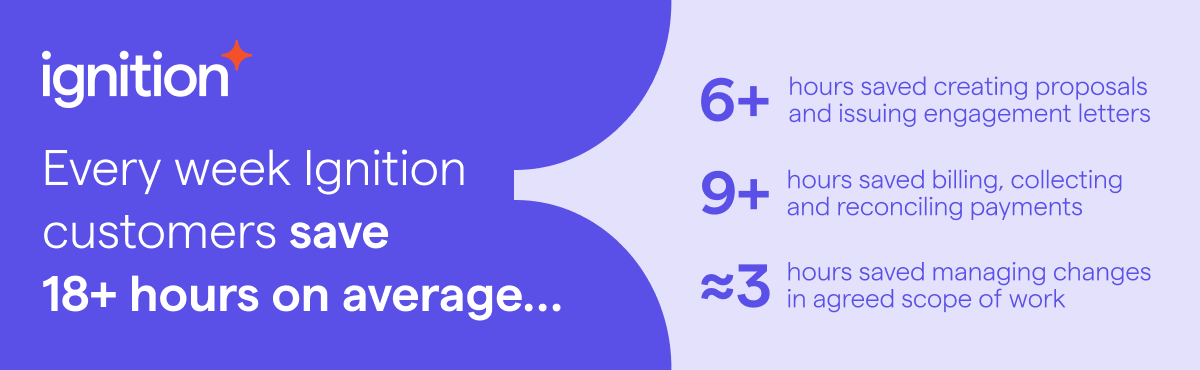

- Ignition's role in streamlining sales: Discover how Ignition – the all-in-one platform that combines proposals, client agreements, billing and payment collection – helps with packaging services, pricing, and saving hours of administrative work.

- Client communication strategies: Understand the significance of regular client interactions – not just during tax season – and innovative ways to keep clients informed and engaged with services.

- Niche specialization: Hear from panelists on the advantages and risks of specializing in specific industries, and how this can impact business during fluctuating economic times.

- Three-tiered pricing models: Delve into the debate on the effectiveness and ethics of using three-tiered pricing models to offer clients different levels of service.

- Ignition's impactful tools: See how Ignition, with features such as upfront payments, online proposals and three-option pricing, can significantly enhance client engagement and increase sales and revenue.

- Practical demonstrations: Watch an on-the-spot demo of Ignition's capabilities in transforming sales and pricing strategies for accounting and tax professionals.

Expert insights for navigating the sales landscape

In our dynamic and evolving landscape, accounting and tax professionals often find themselves grappling with the challenge of effectively selling their services.

Recognizing this essential need, Ignition hosted a special webinar – part three in its Great Debate series – on Exploring different sales techniques.

The session brought together leading voices in the field for a rich exchange of ideas and experiences.

Moderated by Matt Kanas, Ignition's Managing Director for AMER, this hour-long session featured the insights of panelists Kristen Keats from Sherwood Tax & Accounting, Andy Smith of Numberwise Accounting, Anne Napolitano from Anne Napolitano Consulting, and Luke Templin of a2 advisers.

The discussion ranged from how the panelists sell themselves and how (and how often) they communicate with customers, to the pros and cons of finding your niche and the intricacies of three-tiered pricing models.

A demonstration of Ignition with Doron Schweitzer, Ignition’s Senior Account Executive, capped off the session. This tied together the ways in which Ignition can help professional services providers and firms sell themselves, bringing the session full circle.

Read on for a taste of what you missed, then watch other Great Debate webinar in Ignition’s #CallForChange campaign, including Rethinking Tax Season, and Unpacking The Pricing Dilemma.

How are you selling yourself?

Matt Kanas kickstarted the session, introducing himself and Ignition, the all-in-one platform he likens to a late, great Dirty Dancing star.

“We're a triple threat… we're kind of like Patrick Swayze – dancer, singer, actor,” he says.

“We help you package your services and get proposals out the door, help you price, and now we're even venturing into benchmarking… and we save you tons of hours doing that for you.”

He then got the questions underway, shifting the conversation toward sales.

It’s a sometimes outside-the-box topic for accounting and tax professionals who are often more comfortable in the debits and credits realm.

First up: How do you engage in sales discussions with potential and current clients to demonstrate the value of your services?

In other words, how are you selling yourself?

Unconventionally, perhaps, Anne Napolitano does consider herself a salesperson for her firm.

“I spend a good chunk of my time trying to attract clients and then on the client service side,” she says. “We always try to explain to people the value of what we're doing, because I don't really feel like they appreciate it.”

For Andy Smith, he had to shift the way he was selling his services.

“When I originally started the firm and would talk to potential clients, I was very quick to explain all the good stuff we do and try to get to a price and a close as quickly as possible,” he says.

“But over the years, I discovered that when I’d talk about all the cool tax planning or bookkeeping we do, any potential client’s eyes would glaze over.”

His solution?

To implement introductory calls, where the client explains the problems they're having around tax, bookkeeping, or finance.

“Then I tailor our solution around solving their problem rather than explaining the nuts and bolts of what we do… We're not always the right solution, but if I do go about giving them a proposal, it's more about ‘here are your pain points, and here's how we're going to solve those’.”

Luke Templin, a fractional CFO, takes a similar approach: asking a lot of questions and listening to what the client’s trying to solve.

“Most of my clients are trying to grow their business, so my default is: we're going to grow profitability 2 to 3% and then tie that to a business valuation increase,” he says.

Kristen Keats takes a similar approach to that of Andy Smith, but even takes it back a step.

“Even before the initial call, a lot of times the first outreach we get is through email or the website,” she says. “So, we respond with an email being very clear about how we work.”

Then, if the person still wants a meeting after that, that’s when she starts asking why they need a tax preparer or bookkeeping.

Related article: Download your Step-by-step guide to building a scalable sales process in your accounting and tax firm

Elevating client communications

For these panelists and many accounting and tax professionals, asking questions, understanding clients’ initial needs, and acquiring new customers is just the tip of the communication iceberg with clients these days.

Tax time is not necessarily the end-all-be-all it once was for revenue generation, and advisory services are becoming increasingly important for revenue growth.

As a result, more regular interaction with clients becomes essential.

So, when Matt Kanas asked the panelists how often they communicate with their clients, the responses were again varied.

At Luke Templin’s firm, they talk to clients at least on a monthly basis.

“Most of the time, we’re not upselling them anything," he says. “We've already sold them on our top packages.” As such, he says, “We’re getting paid to stay in touch with them constantly.”

Anne Napolitano’s firm is also in touch on a monthly-or-more basis, but her team has taken communication a step further.

“One of the things that we did start doing is sending out an email, maybe once a month or a little less frequently than that, and we call it ‘Did you know?’ – as in, did you know that we offer xyz?”

As a result, Anne and her team have attracted some of their clients to upgrade their services because they didn't necessarily realize what was on offer.

“Maybe it's a client we've had for a number of years, and we started doing bill pay for them… but maybe they don't realize we can handle accounting or advisory for them and offer more. So we started doing that, and we've gotten some really great feedback and we've gotten our clients to go up a few levels.”

It’s a strategy that Kristen Keats is eager to take onboard.

“It's so true, especially for those long-term clients that have been with you forever,” she says.

“Maybe they signed up for one thing, and they don't know you have all this other experience and are able to do those things, so that’s great.”

Her current approach is a bit different, however.

“I purchased Sherwood Tax only three years ago, and I've had to take it from these very traditional once-a-year tax clients and move them to year-round, subscription-based clients,” she says.

“So, at least once a year, I do a video and say, ‘Here are all the services we're doing’ and any changes that have gone on within the firm.”

For Andy Smith, proposal renewal time is an important time for communication.

“That's really a chance for us to have the conversation with clients about what we're doing,” he says.

“Does the pricing still make sense for where their business is? Do they want to add or subtract anything from the engagement?”

What’s more, before Andy’s firm was using Ignition to do proposals and things, his team was not updating the pricing at renewal time.

“At that time, people would come to us with their tax returns, and the tax return would be done, and then we'd be having the conversation with them about how the prices have changed,” he says. “And that was often a tough conversation.”

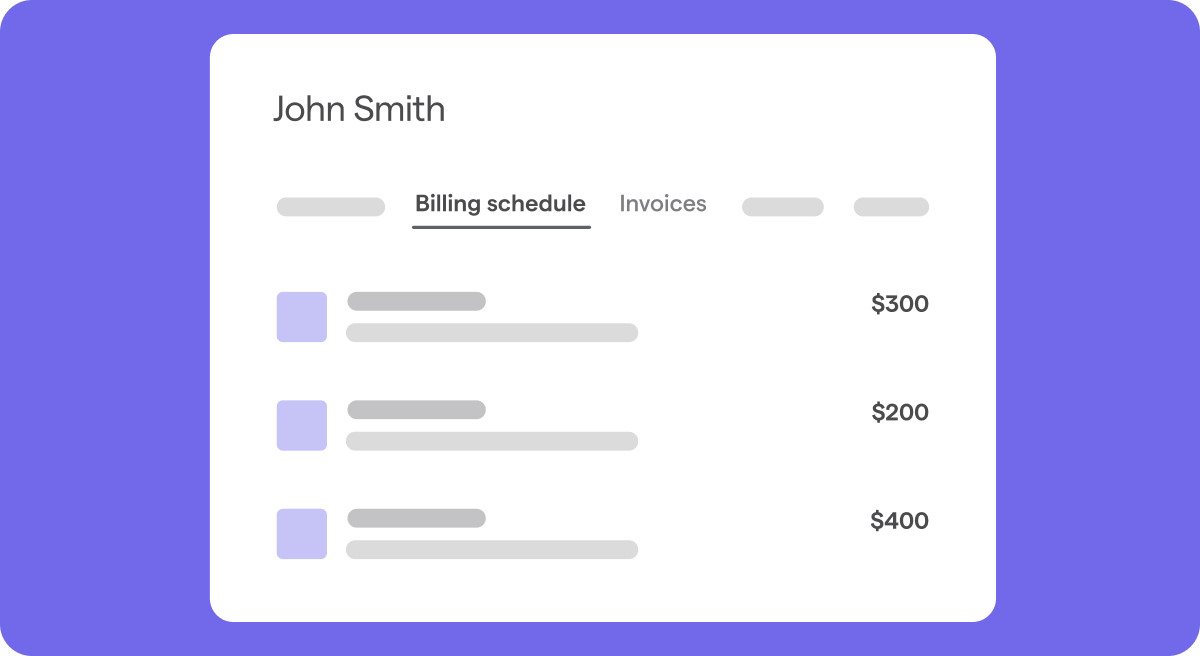

But now, with Ignition, his team is having the pricing conversation upfront going into a new year.

Watch how easy it is: Increase your prices in Ignition with just a few clicks.

Upfront conversations and upfront payments

These upfront conversations, as well as upfront payments, brought to mind the 2023 NATP Tax Professional Fee Study for Matt Kanas.

The survey revealed that only 2% of tax preparers are billing upfront, where no work gets done until clients pay the full price.

Then, roughly 36% are billing on completion, and of those, 36 to 38% are chasing those payments.

“If you juxtapose that to the Ignition survey we did last year, on average in the US, accounting pros are leaving about 80k on the table in AR [accounts receivable] each and every year because of how they're structuring their billing and scheduling,” he says.

To niche or not to niche?

Several of the panelists have established a niche focus, so Matt Kanas posed them this question: Why?

For Anne Napolitano, her firm’s niche is the restaurant and hospitality space, working with a lot of breweries, distilleries, bars, and restaurants.

“We chose that because I was a chef at one point, and I really enjoy working with those types of people. We understand their business, and we have a very good rapport with them,” she says.

However, Anne also learned, especially during the COVID-19 pandemic, that it's a good idea not to fully niche.

“Because, if I had been in the restaurant space during the pandemic, I would have gone out of business,” she says.

“So, I've learned that you need to have a little bit of diversity in there… but having that restaurant and hospitality experience really helps us be experts to our clients and offer a lot of value to them. It also helps us streamline our processes, because they're very similar.”

Talk about tough times during the pandemic! Andy Smith works with a lot of private fitness studios and yoga studios, a niche he fell into.

“We looked at our client list, and we had 10 clients in that industry,” he says.

“So, I said, let's go after it… so now about half of our clients are in the fitness space; the other half are in other industries. What I found is that not only can we streamline some of our processes because we're more familiar with the systems the clients use, but we can also sell them on things that we can’t necessarily sell [to] other clients.”

Three-option pricing

Next, Matt Kanas posed the question of whether using a three-tiered pricing model, such as the one in Ignition, is a little bit manipulative in terms of upselling or cross-selling, as some critics suggest.

Here, the debate was particularly friendly, as all of the panelists use this Ignition feature.

Andy Smith does admit he struggled early with the three-tiered options, especially for clients who were tax-only clients.

“But I realized, if you go to the grocery store, they sell pineapple five different ways at five different prices, depending on if you want it cut up or want the whole thing,” he says. “So, there really isn’t any reason why you can't slice and dice what you're doing into three different options.”

Ignition demo with product expert Doron Schweitzer

The panelists having provided much food for thought, Ignition’s Doron Schweitzer stepped in with a quick but eye-opening overview and demonstration of how Ignition can help transform the way professionals sell and price their services.

Sharing his screen with viewers and using a fictional accounting firm as an example, Doron showcased the platform’s capabilities, including web-based proposals, complete with brand videos and engaging visuals. “This shows your clients that you’re not a fly-by-night operation,” he says.

He also revealed that proposals enriched with audio, visual, and graphical content lead to significantly quicker client sign-ups.

He navigated through the three-option pricing section, a strategic model that generally offers good, better, and best choices.

The demo underscored the innovative approach Ignition offers, empowering professionals to confidently highlight their services and engage clients more effectively.

Where to go from here

We hope this webinar recap got you thinking about your sales techniques and how you can start to change the game with tips and tools.

If you missed the live webinar and didn’t get to see the Ignition in action, you can watch an on-the-spot demo right now. Find out how Ignition automates and optimizes proposals, client agreements, billing and payment collection to put an end to late payments, unbilled work and mundane repetitive admin.