Public practice essentials this EOFY with the ATO

As the end of the financial year approaches, Ignition invited the Australian Taxation Office (ATO) to share their key focus areas and what have been the big changes that will impact tax agents this tax time.

The Public practice essentials this EOFY with the ATO webinar, held on 4th May, had over 3,400 registered attendees. During the session, David New (Managing Director, APAC at Ignition) and I were joined by Matthew Burtt (Risk and Intelligence Director at the ATO), Jacquii Reeves CTA (Associate Director and Head of Tax at businessDEPOT) to discuss everything from individual tax changes, single touch payroll, trust distributions and fringe benefits tax.

So, what are the key takeaways from this session?

1. The changes we can expect this year

There have been quite a number of changes announced for individuals and small businesses that are taking place for 2023 tax time, these are the top three:

- The low and middle income tax offset (LMITO) has been available in recent years for Australian tax residents if their taxable income was less than $126,000. This offset has now ended and taxpayers are no longer eligible from the 2023 financial year onwards. The LMITO for eligible taxpayers earning up to $66,667 is still available.

- Some good news for taxpayers that have eligible self education expenses, their claims will no longer be reduced by $250, with the full amount of eligible education expenses now available to be treated as a tax deduction.

- In line with the increased cost of running a motor vehicle, the cents per kilometre rate has increased to 78 cents per kilometre. But the ATO has warned that taxpayers must have written evidence to substantiate the amount of kilometres that were calculated.

2. Working from home deductions

With the impact of COVID-19 resulting in many Australians now working from home more often, the way taxpayers claim working from home deductions has changed multiple times.

The ATO has now confirmed the current rates that have applied since 1st July 2022 will be staying, with the revised fixed rate method to claim working from home deductions now 67 cents per hour. The previously allowed short cut method is no longer available.

The actual method is still an option for deduction calculations and has not changed, but there has been a removal of the requirement to have a dedicated home office space to be able to claim these deductions.

The record keeping requirements have had a changeup and taxpayers are now required to keep a log of their work from home hours and be able to substantiate this claim under a review.

3. Single Touch Payroll (STP) in action – prefilled activity statements

With STP being in place for some time now, the ATO will be using data collated from STP lodgements to prefill employer activity statements starting from 1st July. This means that via online services, you can expect to see amounts at labels W1 and W2 on business activity statements in the 2024 financial year.

This is a good opportunity for tax agents who may not be involved in their client payroll processing to be able to cross check their client data and STP setup by reviewing this prefill data on a regular basis. Digital service providers will choose what prefill information they will bring into their software. See QC 71218 on ato.gov.au for more information.

4. What about cryptocurrency?

Cryptocurrency investment has been a hot topic for a few years now, and Matthew Burtt confirmed the tax treatment of crypto is the same as most investments, as opposed to being a currency-based transaction.

Like all capital gains tax (CGT) events, if you do make a loss this can’t be used to offset your other income and can only be applied to other capital gains.

Purchases and disposals should be converted into AUD before calculating capital gain or loss and it is important to note that exchanges of one cryptocurrency for another is treated as a CGT event and also resets the ownership period of that currency.

More information can be found on Tax-smart tips for crypto assets investments.5. ATO focus areas this EOFY

Knowing what the ATO is focusing on has always helped tax agents dedicate resources to the right areas of their client compliance. Matthew Burtt highlighted the following ATO focus areas for this end of financial year:

Work-related expenses: The ATO will continue to review the risk of work-related expense claims, especially where there is no private use apportionment of expenses.

Holiday homes and rentals: The ATO is concerned about the way expenses are being claimed on holiday homes and will be reviewing and checking that claims are being apportioned to income, especially where there is a very high level of expenses to income generated.

Super contributions: The ATO will be checking that taxpayers are lodging their intent to claim superannuation notices on time if claiming superannuation deductions in their tax returns.

CGT: This is always a focus, ensuring taxpayers are including gains on investments in their tax returns.

Unpaid super guarantee and PAYG withholding: These employer obligations will be reviewed closely with review activity increasing to ensure employers are paying on time and the correct amounts. The ATO will be leaning on data obtained via STP lodgements to monitor compliance.

Late Taxable Payment Annual Reports (TPAR): TPARs have evolved considerably over the past few years and with this widened scope the ATO will be increasing activity reviewing non-lodgement of TPARs.

Cash economy (hidden wages): Another item that is always an ATO focus.

Watch the on-demand webinar: Public practice essentials this EOFY with the ATO

6. Importance of client engagements

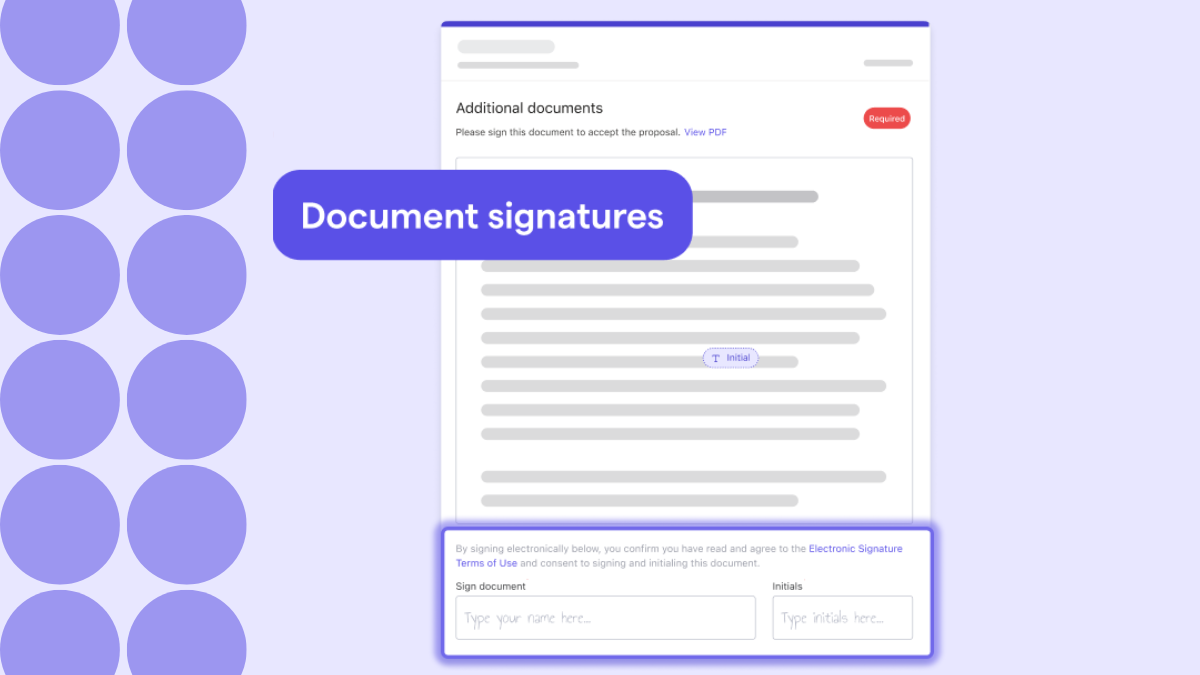

With ever-growing audit and compliance activity being rolled out by the ATO, it’s more important than ever to engage all of your clients for tax work, including individual tax clients. Individual Tax Returns (ITRs) are usually a small fee that only occurs once a year. So sending an engagement letter seems like a lot of work for little reward. But ignoring this vital and important process can expose tax agents to not only compliance risks, but also the risk of not getting paid and a misunderstanding of the service you are offering.

Most accountants and tax agents in Australia must comply with the APESB as a requirement to belong to their membership bodies. The key APESB standards that relate to engagements for tax services are:

APES 220 covers their obligations when providing taxation services. A mandatory requirement of the standard is that, “A Member in Public Practice shall provide the Client with an appropriate statement in Writing outlining the relevant terms of the Engagement to provide the Taxation Service in accordance with APES 305 Terms of Engagement”.

While this does not state that the terms of engagement need to be signed by the client, APES 305 notes that there should be a, “Request for a response from the Client confirming its understanding of the Terms of Engagement as outlined in the Engagement Document. It is preferable for this confirmation of Client acceptance of the Terms of Engagement to be obtained in Writing”.

The easiest way to comply at all times with the mandatory requirements of APES 220 and obtain written confirmation per APES 305, is simply to provide individual tax return clients with engagement letters, and ensure they get signed.

7. Client verification requirements

The ATO has updated the client verification guidance along with the TPB. Tax Agents will need to verify all clients prescribed in the TPBs Practice Note 5/2022.

The ATO is also still rolling out client agent linking progressively, which will see businesses having to nominate their tax agent, as opposed to tax agents being able to just add clients to online services as they currently do.

To find more information on client verification see QC 69794 on ato.gov.au, along with details on client-agent linking.8. Cybersecurity and fraud

Coming into the EOFY the three areas of concern for the ATO are:

Scammers impersonating the ATO.

Taxpayer loss of personal identifying information and documents due to scams.

Ensuring that businesses and tax professionals are implementing strong cyber security practices.

Matthew Burtt shared these essential steps for public practitioners and their clients to manage cyber security risks:

Don’t share your myGovID.

Use a personal email address when setting up your myGovID.

Protect your personal email account.

Keep your smart devices secure.

Turn on notifications for myGovID in your app Settings to ensure you receive verification notifications when accessing online services.

Check myGovID setups regularly.

Protect your identity documents.

Increase the security of your myGovID by verifying additional identity documents.

Report suspected inappropriate access.

9. Trust distributions

Jacquii Reeves provided a high level overview of section 100A and guidance on what tax agents should be doing to help their clients with trust distributions this year.

As a reminder, section 100A is an anti-avoidance rule that can apply where a beneficiary’s trust entitlement arose from a reimbursement agreement. The concern around these agreements generally arise where the beneficiary does not actually receive the income distribution and it’s instead offset against other payments/debts or kept in the trust creating unpaid present entitlements. It’s often found in cases where adult children are beneficiaries in the trust.

This doesn’t mean that you can no longer distribute to adult children, but just a reminder for trustees that when you make a decision to make a beneficiary presently entitled to a distribution it’s a fixed and indefeasible right to that person to call on that entitlement. As such, if a trustee has no intention of making that actual distribution, they will have a s100A issue.

Jacquii Reeves provided the following tips on how she is working with her trust clients:

If you are making your adult children presently entitled, ensure you pay the distribution.

If the trust pays expenses on behalf of the adult child as part of the distribution, the funds should come from the trust and a written agreement should be in place with the adult child and the trustee confirming the expense payments will form part of the distribution.

Ensure that if any offsetting does occur that it’s documented and the adult child is aware and agrees with the arrangement.

Read and be familiar with the trust deed and its provisions.

Ensure the trust hasn’t vested.

Confirm that chosen beneficiaries are eligible under the deed.

Confirm that if you’re streaming, the deed allows it.

If you have made a family trust election, confirm the beneficiary is part of the family.

Make sure your distributions are documented prior to 30th June 2023 to be effective!

Jacquii Reeves also provided a reminder that journal entries don’t constitute a legal agreement and everything should always be appropriately documented.

10. Fringe benefits tax (FBT)

As recently announced by the government, there have been some changes to FBT, specifically for electric vehicles. Benefits provided for electric cars are exempt from FBT if all the following criteria are met:

The car is a zero or low emissions vehicle.

The first time the car is both held and used is on or after 1st July 2022.

The car is used by a current employee or their associates (such as family members).

Luxury car tax (LCT) has never been payable on the importation or sale of the car.

Benefits provided under a salary packaging arrangement are included in the exemption, but it’s important to note this is still a reportable benefit that will be reported to the ATO to be included in the tax return of the person receiving the benefit. This may impact their eligibility to certain offsets and family tax benefits.

In so far as lodgements of FBT returns are concerned, while there’s no obligation for a business to lodge an FBT return if they provide no employee benefits, it’s worth noting the impact this will have on ATO review dates. If an employer doesn’t lodge FBT returns there’s no three year limit on FBT reviews or audits and the ATO can review FBT in the business going back to inception.

Bonus: ATO tips to help you in 2023

The ATO provided some tips to help Tax Agents this tax time including:

- Wait for prefill.

- Encourage those with debts to get in touch with the ATO to negotiate a payment plan.

- Use the new online lodgement deferral process in online services for agents if you need more time.

About the panel

Matthew Burtt is a Director of Risk and Intelligence within the Individuals and Intermediaries business line of the ATO, responsible for managing emerging fraud risk. He has more than 20 years’ experience in compliance, audit and management of various risk areas and the delivery of client engagement products across the Individuals, Small Business and Employer Obligations markets. He made significant contributions to the establishment of approaches to dealing with compliance risks in the Intermediary population. Matthew Burtt has also played a key role in the development and implementation of PAYG withholding policy and practice and has led the implementation of tax rate changes announced in Federal Budgets. His current role brings together his broad experience in client engagement with his keen interest and focus on systemic compliance issues to maintain a real-time risk assessment and treatment of fraud-based lodgment behaviours in the Individuals market.

Rebecca Mihalic is an Australian Registered Tax Agent and a Fellow Chartered Accountant. She has been working in public practice since 2003. She was a co-founder of Aptus Accounting & Advisory, which was named the 2018 Innovator of the Year at the Australian Accounting Awards. Rebecca Mihalic now heads up the Sydney accounting operations of businessDEPOT. She has earned a reputation for her leadership, passion and commitment to the accounting industry and recently won, 'Thought Leader of the Year' in the prestigious 2021 Australian Accounting Awards.

Jacquii Reeves, is also a Chartered Tax Advisor and is an Associate Director & Head of Tax at BusinessDEPOT, a ‘one place for business’ that provides an array of professional services to the SME market. With over 15 years’ experience in Public Practice and five years working in Big 4, she plays a key role as business and personal tax expert to many high net worth individuals and family owned businesses. A regular contributor and presenter with the Tax Institute, Jacquii Reeves has a passion for finding solutions to complex tax issues and enjoys working with clients to navigate the best tax outcome for their personal situation.

For the full discussion, watch the Public practice essentials this EOFY with the ATO on-demand video. This tax year, it’s more important than ever to engage your clients, but it doesn’t have to be time consuming. With Ignition, you can create and send proposals and engagement letters in minutes with custom templates you can use time and time again. To find out more, watch the online demo