Tips for developing a technology change management process for your accounting firm

The accounting industry is in a constant state of evolution, with new technologies driving many of the changes. Incorporating digital transformation can bring significant benefits to your firm. But what exactly is digital transformation? It involves businesses integrating digital technology throughout their organizations, resulting in a fundamental shift in operations and the delivery of value to customers. This cultural change involves ongoing experimentation and challenging the status quo. The benefits of digital transformation are numerous, including increased efficiency, improved accuracy, and better client service. However, the process of implementing new technology can be challenging and disruptive.

Read on for our step-by-step change management guide to developing a process for changing technology in your firm.

A step-by-step guide to implementing new technology in your company

Change management is a structured approach to planning and implementing changes within an organization. It involves working with people both to reduce resistance to change and to help them embrace changes that may occur for example, with the introduction of new technology, systems and processes. Ultimately, the goal of change management is to facilitate successful transformation processes.

Why change is important

In the accounting industry, managing change is particularly important when adopting new technology. Accounting firms must make sure their staff has the knowledge and skills to make the most of new technologies. This requires a well-planned and coordinated approach to change management that focuses on communication, risk assessment and risk management, monitoring and evaluation, and training and support.

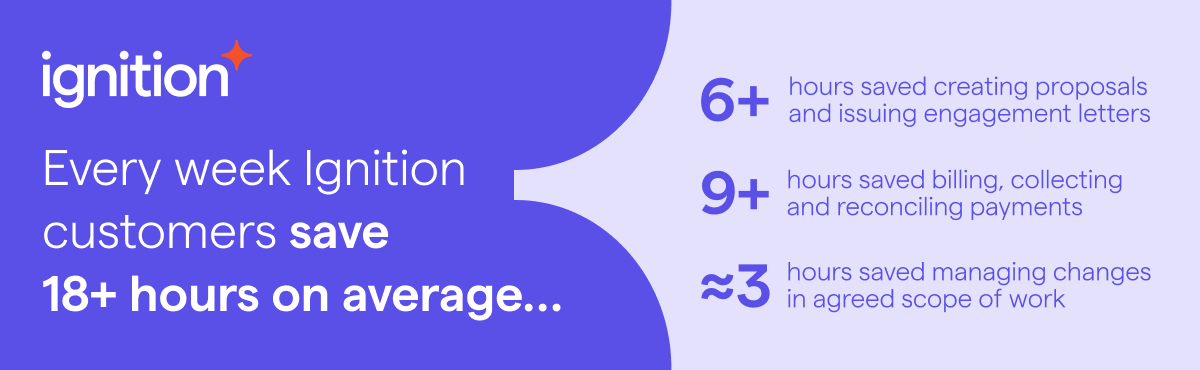

Ignition, for instance, which is an all-in-one platform for professional services, enables change management by automating business processes. By automating routine tasks and centralizing data, the platform frees up teams to focus on strategic initiatives and helps accounting firms better manage their resources and workloads.

Developing a change management process

There are a number of steps involved in developing a process for managing change for accounting firms wanting to implement new technology in their business.

Step 1: Assess the need for change

So, when is it time to change technology within your company? First, it's crucial to determine the problems and reasons behind making a change so you can align all stakeholders on the greater purpose. For example, you might be struggling with late payments, and billing and getting paid on time for all the work you do. You may also find managing scope creep a challenge, and consider hours on admin – such as preparing proposals or engagement letters – is leading to inefficiencies in your firm. Challenges such as the cost of writing off aged receivables and cash flow fluctuations are also very real problems that can lead to a need and desire for change.

Once you identify the issues, prioritize them based on their impact on your firm and the potential benefit that you could gain by addressing them.

Top tip: Select a champion on your team as the main person to communicate and lead the project. This individual should be someone who can clearly articulate the need for change, gain buy-in from stakeholders, and ensure that everyone is working together toward the common goal.

Step 2: Choose the right technology

To enable your organizational changes, choosing the right technology products is critical to the success of any managing change process. You should identify and evaluate potential options that address the problems or reasons for change that you pinpointed in the first step.

To select the right products or platforms, consider the specific needs of your accounting firm. This can include factors such as the size of your firm, the complexity of your operations, and the number of clients you serve. Also think about the potential costs and benefits of each option, including the initial investment and ongoing maintenance costs.

Ignition, for example, helps accounting firms become more efficient and move towards achieving a zero accounts receivable practice. With its comprehensive proposal and engagement letter templates and automated collections process, the platform can help firms reduce errors, save time, and get paid faster. Additionally, the ongoing education provided by Ignition helps to ensure successful technology adoption and use.

Once you select the best technology option for you, you can then develop an implementation plan that outlines the specific steps your firm needs to take to integrate the new technology into your firm's operations.

Top tip: When selecting technology, consider the usability and compatibility of the potential solution with your existing systems. Integrations are a powerful way to automate your workflows and free up valuable time.

Download the checklist: Get the 6 simple steps to becoming a zero accounts receivable firm checklist and start eliminating AR and improving your processes today.

Step 3: Create a change management team

To make sure your change management process succeeds, it's a good idea to assemble a team that can guide your accounting firm through this transition. If possible, this team should comprise individuals from different areas of your firm and have a mix of skills, such as project management, communication, and technical expertise. Your change management team should also have a champion (see Step 1) who can motivate and guide the group throughout the change management process.

What’s more, you want people who can help communicate the benefits of the change to others in the firm. Try to involve staff who may be resistant to change, as they can provide valuable feedback and often help overcome resistance from others. The team should also work closely with the technology vendor to ensure smooth implementation.

Top tip: Make sure your change management team has clear goals and objectives. Consider developing a project charter that outlines the scope of the project, including a RACI (this details who’s responsible, accountable, consulted and informed) a timeline, and budget. This helps to keep everyone on track throughout the change management process.

Step 4: Develop a communication plan

Clear and effective communication is essential for making sure that all stakeholders are on the same page and have a shared understanding of the changes that are happening within the accounting firm. The plan should detail:

Key messages.

Stakeholders.

Communication channels.

Timelines.

Communicate with all stakeholders throughout the change process to keep them informed, engaged, and onboard.

To develop an effective communication plan, first identify anyone the change will impact. Then, determine what information each person needs to know and when they need to know it. Next, decide on the best communication channels to reach each person. This may include email, in-person meetings, webinars, or other methods.

Keep in mind, too, that communication is a two-way street, so encourage feedback from stakeholders to understand their concerns and respond to them. This helps to build trust and buy-in from stakeholders, making them more likely to embrace the change.

Top tip: Tailor your communication plan to the needs and preferences of each stakeholder. Consider their level of involvement, knowledge, and interest in the change, and adapt your messaging and communication channels accordingly. Also, be transparent and honest about the reasons for the change and the expected outcomes.

Step 5: Identify potential risks and challenges

Once your change management team and communication plan are in place, it’s time to identify possible threats and difficulties that could arise during the implementation process. As part of your risk assessment, you want to pinpoint any factors that could prevent or hinder the success of your change management process, including technical limitations, resistance to change, lack of resources or expertise, and potential disruptions to day-to-day operations.

By identifying these potential risks and challenges early, you can take the proper risk management steps to mitigate or address them before they become major obstacles to your change. This may involve providing additional training or resources, updating the communication plan to address concerns or questions, or revising the implementation timeline to allow for additional preparation or testing.

Top tip: Involve others in the risk management process; solicit feedback and concerns from employees and other key stakeholders. This can help make sure that your firm addresses any risks and challenges in a timely manner.

Step 6: Monitor and evaluate the change

This step helps make sure that the implemented changes are achieving their desired outcomes and that your firm responds promptly to any issues that arise. To monitor and evaluate your change, establish clear metrics for measuring success and set up a system for collecting and analyzing data.

One effective way to do this is to use a dashboard that provides real-time data on the performance of the new technology and the impact it’s having on your accounting firm. This, too, helps quickly identify any problems that rear their ugly heads and allows for timely intervention.

Top tip: Set up a system for continuous monitoring and evaluation of your change, including regular check-ins with stakeholders and real-time data collection and reporting through a dashboard.

Importance of training and support

Training and support are critical components of a successful change management process, particularly when implementing new technology. Without adequate help, employees may struggle to use the new technology effectively, which can lead to frustration, resistance, and decreased productivity. So, education is key to ensuring a smooth transition and for maximizing the benefits of any new technology.

Often, education can be tailored to the specific needs of each team and individual, with a focus on the practical applications of the new technology. This includes providing employees with clear instructions on how to use the software, as well as opportunities for hands-on practice and ongoing support. This support should be readily available to address any questions or concerns that arise during the transition process.

Ignition, for example, offers on-demand webinars that provide users with the flexibility to learn at their own pace. Ignition’s live webinars also provide an opportunity to see the platform in action, with experts providing a demo of the platform at the end of the sessions and taking contact details from attendees if they would like to find out more.

Strategies for empowering your staff to make the most of your new technology

To fully reap the rewards of your new tech, your team must have the knowledge and skills to use it effectively. Implementing it without bringing your team along for the ride can lead to frustration, errors, and low technology adoption rates.

The following simple strategies will have them ready and raring to go:

Offer educational resources that are readily available to ensure your team understands the technology's features and functions.

Provide on-demand training materials, such as user guides, tutorials, and webinars, so they can access these whenever they need them.

Assign internal advocates to support and guide other employees as they transition to the new technology.

Encourage employee feedback, including the tech’s usability and any areas where they may be struggling. You can then use this feedback to refine the training approach and the technology itself.

Recognize and reward early adopters who embrace the new technology, demonstrate proficiency, and help others adopt it. This helps create a positive feedback loop and drives widespread technology adoption.

Over to you

Now that you have a clear roadmap for developing a change management process, you can help your accounting firm successfully implement new technology and stay ahead of the competition.

To help keep you on track, Ignition has also developed a ready-to-use six-step checklist that can further help accounting and tax professionals improve your processes and eliminate accounts receivable. You can download the checklist now.