Reconciled doubles revenue growth and slashes proposal time by ~83%

By streamlining proposal management and shifting its billing practices with Ignition, Reconciled has reduced the time spent on proposals, improved cash flow, and provided clients with a frictionless experience.

Reconciled’s 8-step growth playbook

Discover how to run the smartest business.

Reconciled’s 8-step growth playbook

“Ignition allowed us to more than double our revenue. It's replaced and sped up the proposal and sales process and we can scale the number of proposals we send out.”

Michael Ly, Co-founder and CEO, Reconciled

The challenge: Inefficient proposal and billing processes inhibiting growth

Before Ignition, Michael used a tedious, multistep sales process. He would create proposals in Microsoft Word, convert them into PDF files, and email them to clients. Then, he would use QuickBooks to send invoices.

Needless to say, the workflow was highly manual, and the fact that it involved tools that didn't connect to each other meant there was more room for error.

Because the process was labor-intensive, Michael spent quite a bit of time creating proposals, which created friction in the sales process.

He knew there had to be a more scalable way to present and sell his services to clients.

“I was trying to find a solution that would automate that process, make it more scalable, and take away the pain of having to edit Word documents and send them via email as attachments,” he says.

The mess of manual invoicing

Reconciled’s manual invoicing process was also adding to the firm’s administrative burden.

"I needed automated billing so that I wasn't relying on manual invoices and hoping that the customer would pay," Michael says.

The time Michael and his team were spending on invoicing and following up on late payments detracted from valuable client work and strategic growth initiatives. Without an automated system, the firm faced delays in cash flow and unnecessary administrative headaches, making it difficult to scale effectively. This inefficiency underscored the need for a more streamlined, automated approach to billing and payments.

Distraction from client satisfaction

Spending time on manual tasks and all the to-ing and fro-ing with client proposals were causing friction in Reconciled's client experience. Michael recognized that in this day and age, customers demand quicker, more seamless interactions. He understood that continuing with outdated methods was not sustainable for maintaining client satisfaction and growing his business.

The solution: Unlocking higher productivity and revenue growth with Ignition

Michael came across Ignition at QuickBooks Connect and decided to sign up for the platform as an early adopter in 2017. This decision, he says, has been a game-changer for Reconciled.

Perfected proposals for peak sales performance

"Ignition allowed us to more than double our revenue. It's replaced and sped up the proposal and sales process and we can scale the number of proposals we send out.

“Before Ignition, I would spend 15 to 30 minutes on a proposal. Now, I spend five to 10 minutes, depending on how complex they are for the customer," says Michael.

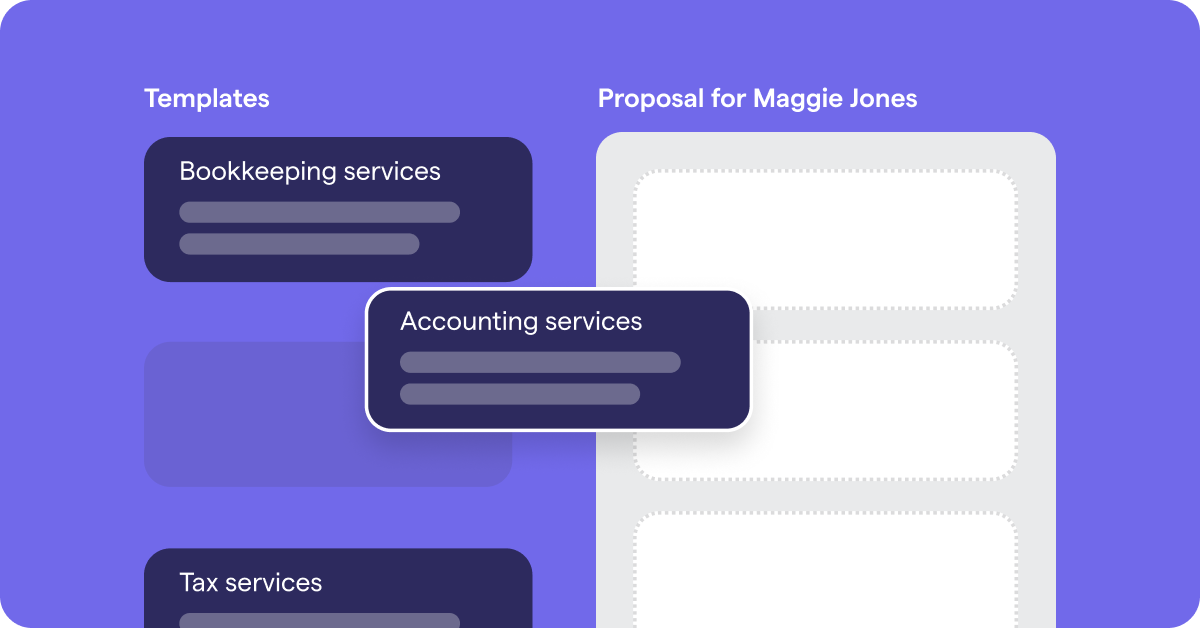

Beyond the time savings, Michael says Ignition has paved the way for scalability, enabling him and his team to expand their capacity and drive sales. What’s more, Ignition has a slew of templates that businesses can use for their proposals, or they can upload their own.

“Ignition makes it effortless to present our services to clients via a professional proposal. I love that we can very easily present extra services for clients to add on themselves and generate more revenue without the hard sell.”

Billing and payments made easy

Michael also no longer has to worry about getting paid when he sends a proposal and starts a client engagement. With Ignition, he can capture payment details and set up automatic billing when clients review and sign the documents, so he can rest easy knowing he won’t have to chase late payments.

"Ignition allows us to bill and receive payment from our customers automatically on a monthly basis and replaces having to manually invoice out of our accounting system," he says.

“We reduced our year end AR as a percentage of annual revenue by 20% after the first 12 months of implementing Ignition.”

As a result, Michael stresses the need for accounting firms to move away from traditional time-and-material billing to value-based billing. "Shifting out of that mindset, where you're no longer billing just for hours spent – you’re actually billing for value – that's going to be a big shift still for many firms," he says. But this shift allows firms to better quantify the value they provide to clients and ensures clients understand and appreciate the services they receive.

Reconciled’s 8-step growth playbook

Discover how to run the smartest business.

Reconciled’s 8-step growth playbook

Enhanced client experience

This customer experience is key. “Customers are used to frictionless experiences when they engage in the new economy and when they engage both software and service providers,” says Michael. “So, for you to stand out amongst your peers as a more modern firm and one that understands the need to create a frictionless experience for customers, implementing a system like Ignition is going to help you with your customer experience overall and also make your work easier when trying to scale your practice.”

After all, he says, “your clients aren't paying for you to spend time crafting the best Word document proposal. Your clients are hiring you because they want advice and they want to experience you as a service provider that can stand out to them.”