Shift to advisory and upfront payments unlocks 36% revenue growth

Tiffany W Davis, PA, MSM, CEO, and President of Washington & Co Inc, uses a progressive mindset – combined with Ignition – for pricing, packaging, and payments to generate year-round recurring revenue.

Washington & Co’s 8‑step growth playbook

Discover how to run the smartest business.

Washington & Co’s 8‑step growth playbook

“Now we stick to the scope of services; we don’t do anything for free anymore, I will not move a pen, a mouse – nothing – until a proposal is signed.”

Tiffany Davis, PA, MSM, CEO and President of Washington & Co Inc.

The challenge: Problematic pricing and unstructured service offering

A period of intense pressure and uncertainty during the COVID-19 pandemic tested the resilience of businesses worldwide. For Tiffany Davis, it presented an opportunity to further transform her firm’s operations.

When she first adopted Ignition in 2021, Tiffany’s primary goal was to automate essential but time-consuming tasks when engaging clients, such as collecting payments and preparing proposals.

“I was the person doing all the payment processing,” she says. “Because I was responsible for that process, if I wanted to take some time off and go on vacation and there were payments due, guess what? I still needed to process them. Well, maybe I didn't want to have to process payments anymore! I still had to be thinking about work, when in actuality, I shouldn't be.

“I should be enjoying my time off … and be able to truly disconnect from the business, which is very important for us as entrepreneurs that we do have that work-life balance.”

Desire to take technology a step further

So, Tiffany found herself wanting to simplify her firm’s pricing structure and standardize its services into strategic packages. This would not only help clients navigate the pandemic, but also spread revenue throughout the year, rather than concentrating it solely during tax season – or, as Tiffany calls it, ‘no-life’ season.

The solution: Rethinking pricing, packaging, payments, and services

This spurred Tiffany Davis to reconsider and innovate her firm’s approach to pricing, packaging, and payments, leveraging Ignition’s capabilities.

Expanded service offering: Advisory

First, she expanded her offering into advisory services. The move into advisory services also allowed Tiffany to implement more premium pricing to reflect the specialized skills necessary for advisory. “We also changed the pricing for individual services, because it's a higher value to the client when you have the tax advisory services,” she says.

“With our new and refined pricing model, tax preparation for individuals that we see once a year, increased 150%. This allowed us to focus on providing high-valued services to our clients and at the same time, decreasing our workload, and it didn’t hurt that we were also making more money.”

Three-tiered packaging: Clients love options

Second, she created three distinct service packages:

“While thinking about the clients’ needs and how we could show the value of our services in a simplified method, creating three service offerings was the solution. Everyone loves to have options, and we figured out a way to make it simple,” she says.

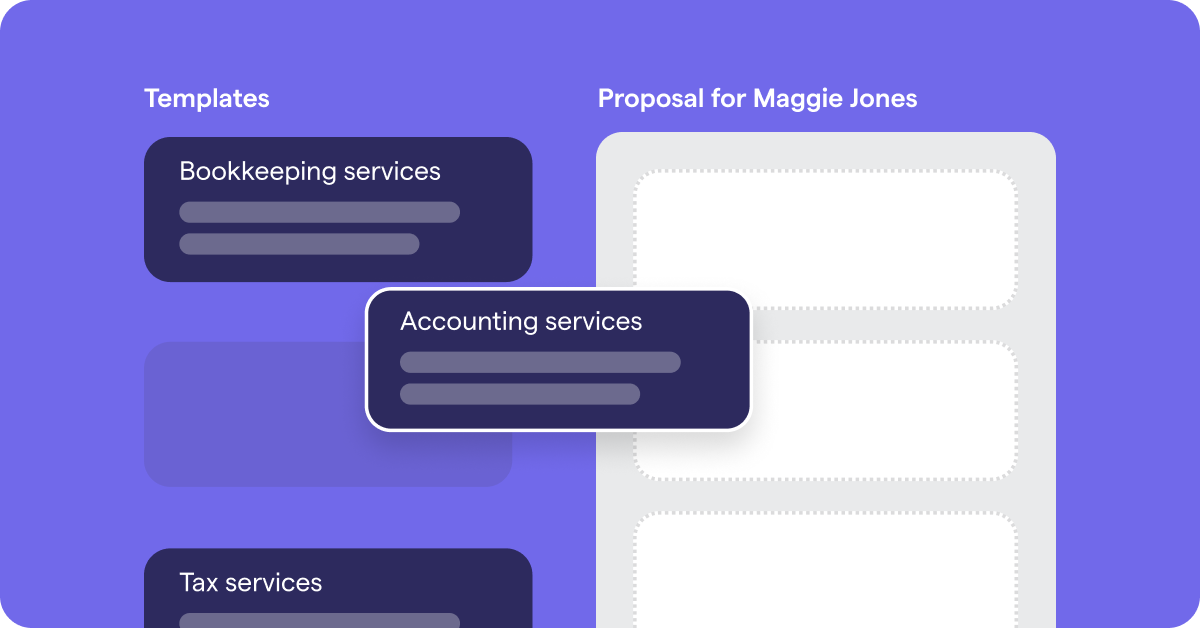

Ignition’s three-tiered pricing options easily enabled her to create these customized packages to meet her clients’ varied needs.

Upfront payments: Get paid first

This approach also helped Tiffany ensure more consistent revenue throughout the year, as her package options are now tied to upfront, automated payments through Ignition.

These automated payments also gave Tiffany a bit of her life back. “So, now, when I'm out on a Saturday with my son, Ignition is ensuring there's a payment coming in for somebody that has something due on that Saturday,” she says. “Automation is the way to go. If you're not automating, you're wasting so much time.”

Tiffany’s mindset also shifted in line with her business model.

“Now we stick to the scope of services, we don’t do anything for free anymore,” she says. “I will not move a pen, a mouse – nothing – until a proposal is signed.”

Tiffany’s stance on upfront payments and the value of her services has become a cornerstone of her firm’s success. What’s more, by taking advantage of Ignition’s automated payments feature, Tiffany has optimized her firm’s cash flow and minimized the financial rollercoaster of tax season.

Washington & Co’s 8-step growth playbook

Discover how to run the smartest business.

Washington & Co’s 8-step growth playbook

Consistent client experience

Tiffany adds that leveraging Ignition not only makes you more efficient, but also creates consistency for clients. “All of your clients are getting the same level of service, regardless of the work you’re doing for them. They're getting that same touch – whatever that touch is that you want to give them.”

What’s more, sending a proposal to a client takes less than a minute when using proposal templates.

"It's pretty quick, especially if it is a template proposal. It takes less than a minute, or 1 to 3 minutes for Tax Planning or CFO if I need to make any adjustments to pricing or package options.”

Tiffany’s progressive approach sets her apart in the industry, defining her brand as innovative and client-focused. This holistic and forward-thinking strategy exemplifies her commitment to not only adapting to change, but also thriving in the thick of it.