Debt recovery using Ignition

There are a ton of reasons why a client might not pay for their invoices.

Sometimes, they simply forget to pay an invoice. Other times, they might have some cashflow issues preventing them from paying their bills. Or they might have an outstanding debt from a previous engagement or project.

Whatever the case, Ignition can help you recover this debt and any other outstanding debts/accounts receivable and eventually eliminate debtors altogether!

Please note: This method uses Ignition payments. Learn how to set up payments here.

Setting up service templates

The first step is a quick setup of some Outstanding Payment service templates.

Navigate to your Library → Services tab → New service.

Then, add these two services below.

Alternatively, you can create a new service within the Services step when you are creating a new proposal.

Lump sum

Service name: Outstanding Payment (Lump sum)

Service description: This is your current outstanding payment as of <DATE> for <PREVIOUS WORK/PROJECT>.

We will need this to be paid in full before any work continues with your new engagement.

Default billing type: On Acceptance

Standard Price: $0 (Note: We will change this on a proposal by proposal basis)

Payment plan

Service name: Outstanding Payment (Payment plan)

Service description: This is your current outstanding payment as of <DATE> for <PREVIOUS WORK/PROJECT> that will be split over <TIME PERIOD>.

We require payment plan sign-off before any work continues with your new engagement.

Default billing type: Recurring

Monthly Price: $0 (Note: We can change this cadence on a proposal by proposal basis)

Creating a proposal

Create a new proposal and assign it to the client of your choice.

In the General step, set the Proposal start date to On acceptance and the Minimum contract length to 1 month if you are intending to collect a lump sum and 12 months (or a custom length) if you are offering a payment plan.

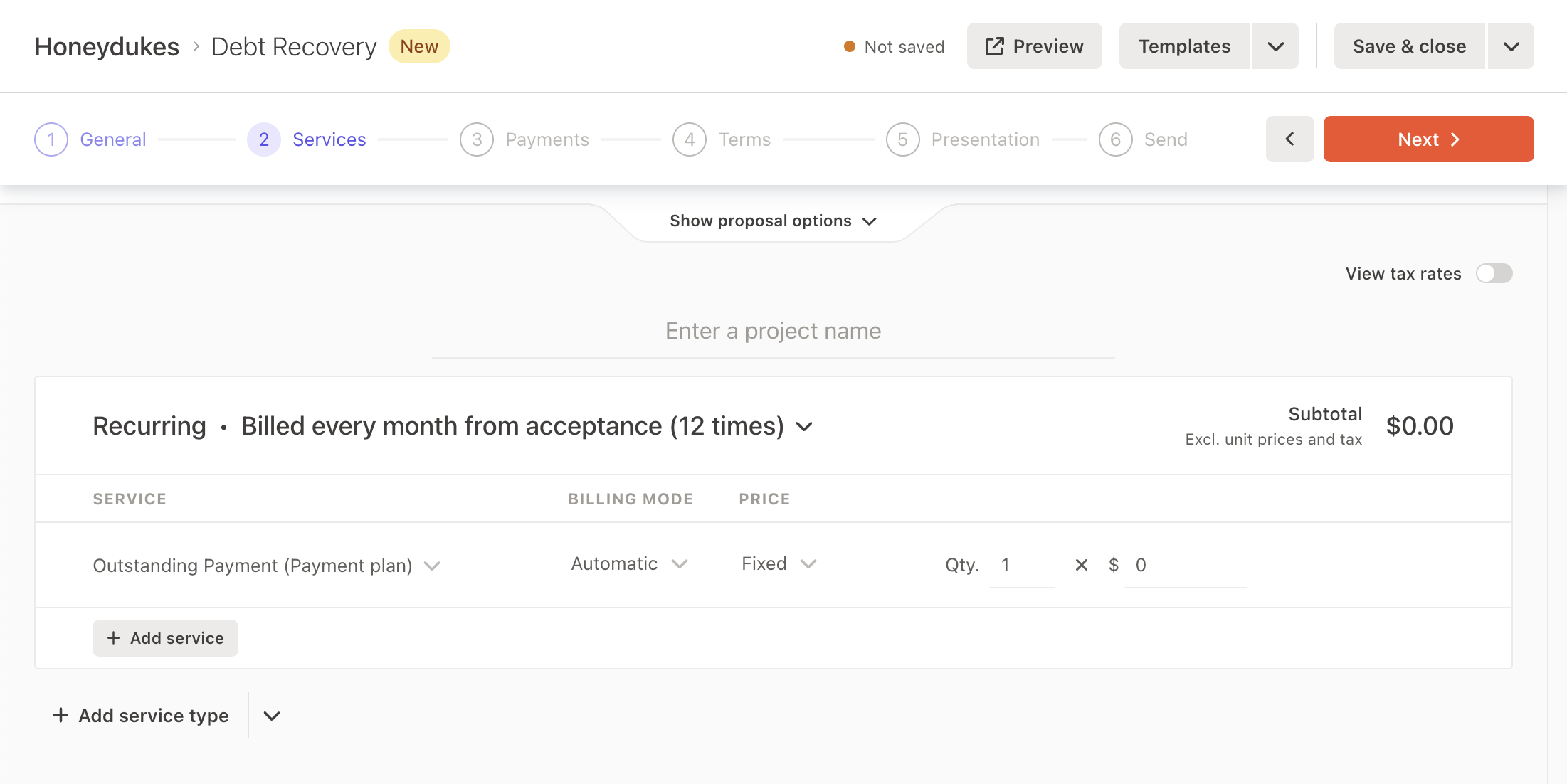

In the Services step, add the relevant Outstanding Payment service in and select the relevant service type depending on how you want to bill (i.e. Recurring, One-off or Deposit).

If you haven’t created the service templates yet, you can do so in this step.

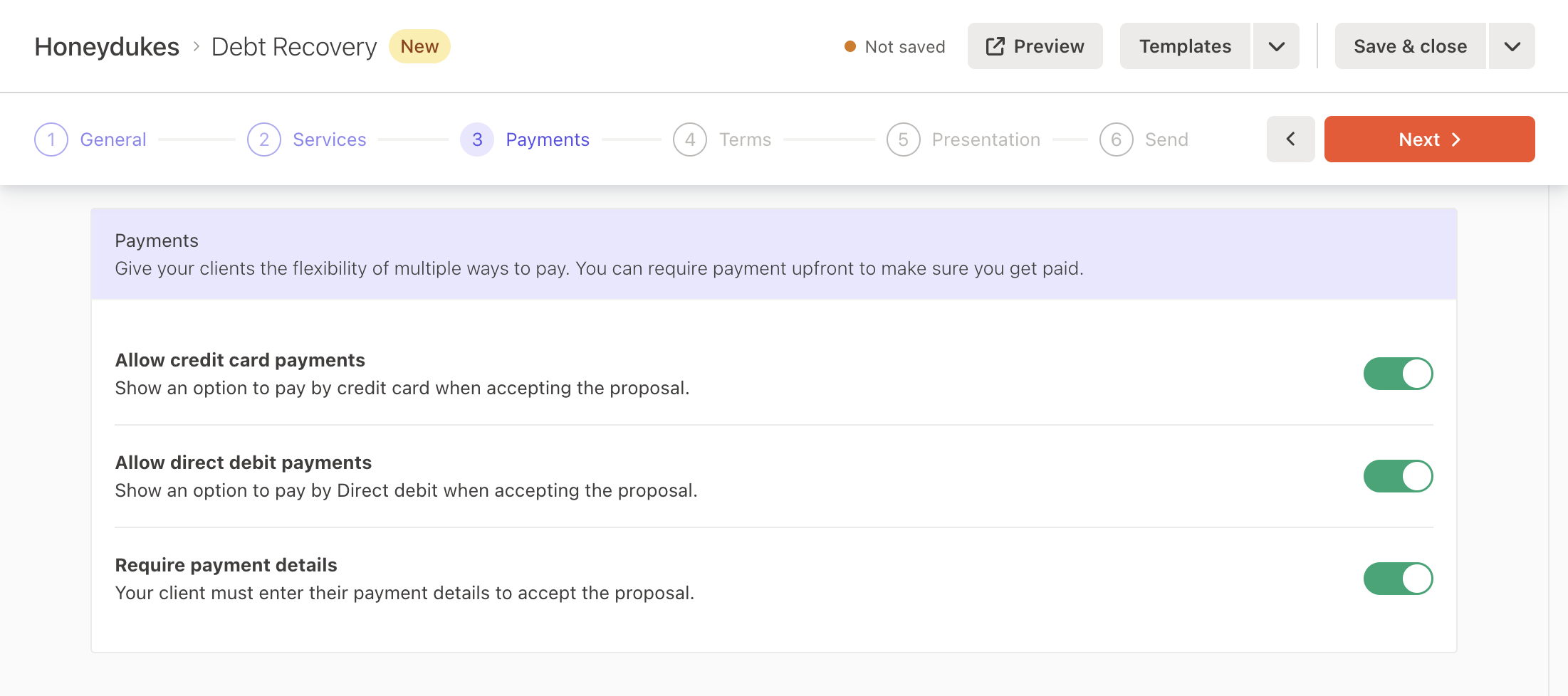

Ensure that you enable the Require payment details toggle in the Payments step.

This is a crucial step that ensures you’ll be able to collect payment from your client. Your clients will need to enter in their payment details (if they haven’t already) in order to accept the proposal.

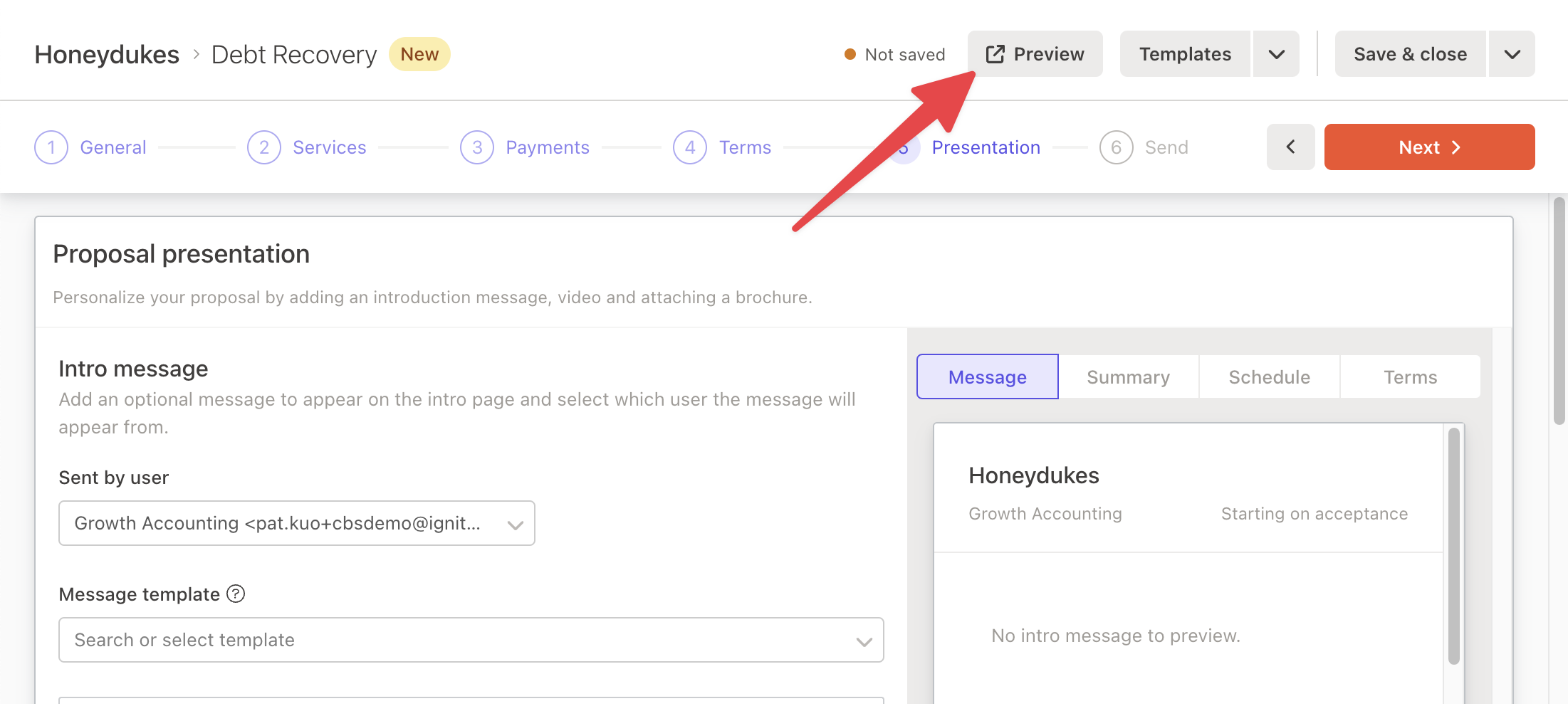

Next, review the Terms and Presentation steps and make any changes you want.

Remember to preview the proposal to see how this looks from your clients perspective.

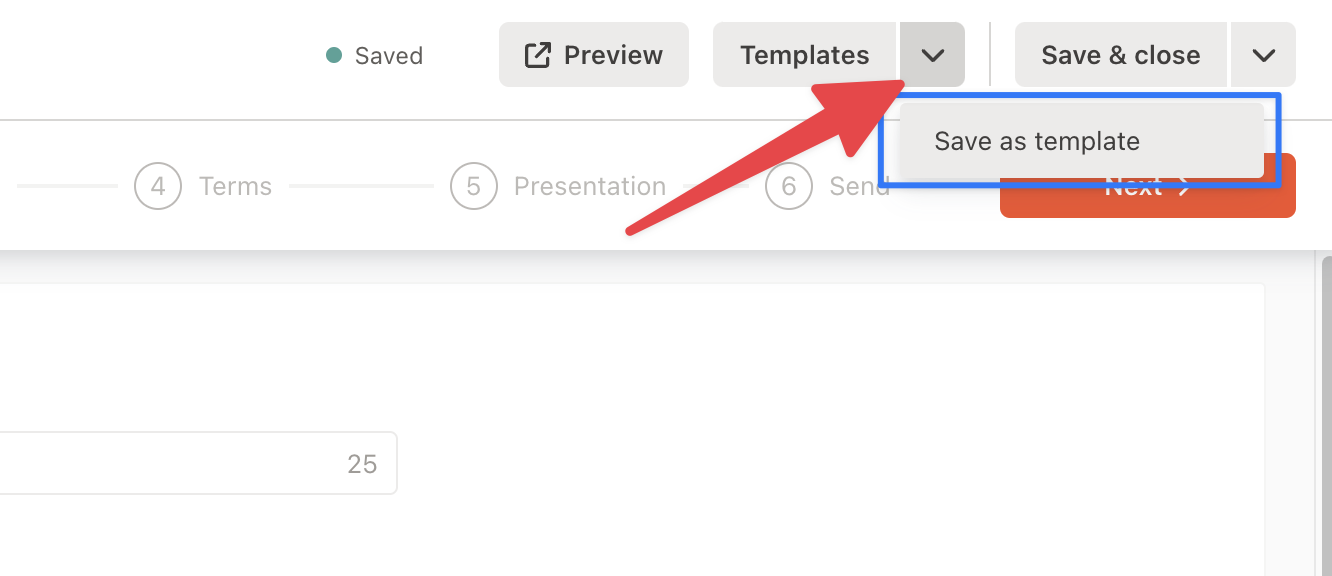

Once you’re ready, send it to your client in the Send step.Saving as a custom proposal template

Using proposal options to collect debt

If you are on a Professional or Scale plan, you can also use proposal options and include both the lump sum and payment plan services as options your clients can select.

If you wish, you can also provide a discount or tweak the pricing to encourage your clients to select an option that works best for you (e.g. providing a discount to collect upfront - see example below).

You can also save this options proposal as a custom proposal template to use in the future, too.

Creating proposals in bulk

If you have a lot of debtors, you may want to consider using our bulk proposal creation process.

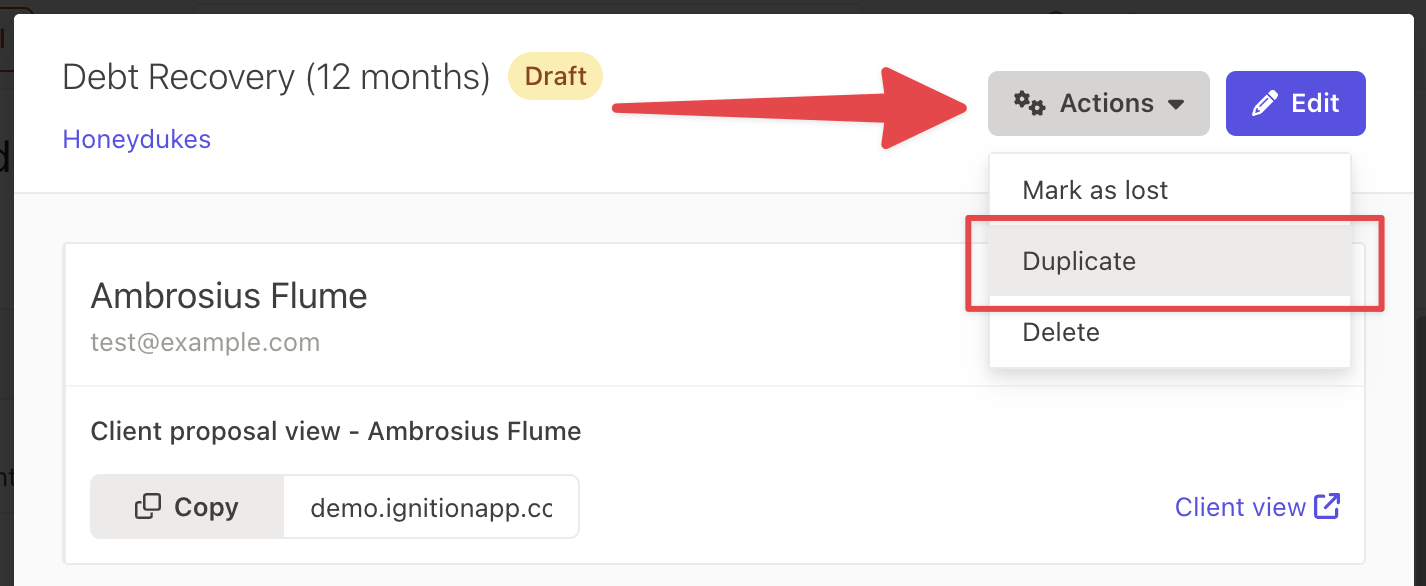

We suggest this process when you need to create 20 or more proposals. Otherwise, we recommend using custom proposal templates or simply duplicating the debt recovery proposal.

US

US