Introducing card processing fees to your clients (surcharges)

How can I pass on card processing fees?

Ignition gives you the flexibility to pass card processing fees onto your client if you choose to.

You can use this feature by enabling the card fees toggle in your Settings → Payments tab. Learn more about enabling this feature here.

However, we recommend you read this article in full in order to understand the best practices before you activate this feature in your account.

Note: This feature will add an extra fee to your clients’ bill if they choose to pay by card, and all surcharges paid by your clients are applied to your account as a credit against your Ignition processing fees. See this article for more info.

This article also assumes that you are currently using Ignition payments. If you are not using Ignition payments but would like to, see this article for setup instructions.

Introducing card surcharges to your clients

If you’ve decided to adopt card surcharging, we’ve put together some best practices and example emails that you may wish to use to help communicate this change to your clients.

Update your terms templates to include card processing fees

We strongly recommend that you include a paragraph in your terms template that covers card processing fees if you are using this feature.

This protects your practice by enabling you to be transparent and open about your service fees and processing fees in all of your proposals.

We have provided a short section below that you can add to your terms templates.

Please ensure that you consult your legal contact to review your terms templates before sending to your clients.

If your clients’ agreements currently do not have these terms in their active engagements, consider sending a new proposal with these terms attached.

Card processing fees

In the event that {{ client.name }} chooses to make payments via card, a card processing fee will be applied. This fee covers the charges for processing card transactions and is not included in the standard service fees. The card processing fee will be calculated as a percentage of the total invoice amount and will be clearly indicated when a card is entered in our platform. It will also appear on all the invoices provided.

{{ client.name }} acknowledges and agrees to the application of this fee when opting to pay by card. The specific percentage for the card processing fee can be subject to change and if so, we will communicate as early as possible.

Communicate to your clients about passing on card fees

It’s incredibly important to communicate early with your clients about any additional fees that you may charge, including card processing fees.

You could notify your clients whilst allowing them to change their payment methods (see the next section), however it’s best practice to communicate as early as possible.

We’ve included a template email below that you can use and tweak for your client communication. Note that this includes a paragraph about using bank account payments instead (see scenarios section below).

Feel free to use this as a base template and change it according to your own needs.

Email template

To {{ client.name }},

We hope this message finds you well.

We want to inform you about an important change to our payment processing procedures that will affect your transactions going forward. We greatly value your business and want to ensure transparency in all aspects of our services.

Starting on [EFFECTIVE DATE], we will be implementing a small card processing fee for all credit card transactions. This fee is necessary due to the rising costs associated with card processing. We understand that this might raise concerns, and we want to assure you that we have introduced a bank account option that can help you avoid this fee entirely.

We’ll soon be sending you an option to add bank account details to your account, which will not incur processing fees. If you’d like to swap to a bank account option, we’ll use the new bank account details to collect payment for all future invoices.

If you have any questions, please do not hesitate to contact us.

Kind regards,

{{ practice.name }}

Best practices for common scenarios

The approach you take with surcharging will depend on two main scenarios:

- You are already accepting card payments but are now introducing surcharging.

- You did not previously allow card payments but now wish to introduce card payments with a surcharge.

Introducing surcharging to all existing card payments

It’s important to communicate the change in advance to all clients who are already paying you by card.

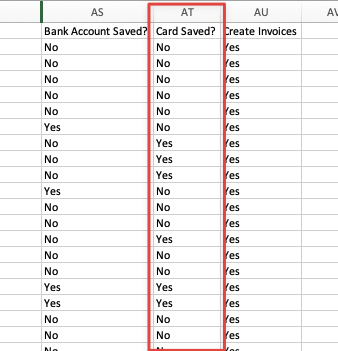

You can identify all of these clients by exporting your client list and filtering on the “Card Saved” column.

In this scenario we recommend you should:

- Choose an “effective date” from which you will start to apply surcharges.

- Communicate the effective date and surcharge rate in advance.

- On the “effective date”, enable surcharges in your Ignition account.

You can also let clients switch to a bank account payment method (ACH / Direct Debit) if they prefer. You can let clients do this themselves by including the “Payment Portal Link” in your email. To get these links, export your client list and look for the “Payment Portal Link” column. Note that the link for each client is unique.

Alternatively you can use our bulk payment request feature (see section below).

Below is an email template that you can use to communicate with your clients.

Subject: Important Update: New Surcharge for Card Payment Methods

Hi {{ client.name }},

Hope you've been well!

We wanted to reach out to let you know about some upcoming changes to {{ practice name }}’s payment processes that might affect the way you make payments to us.

As of [EFFECTIVE DATE], card payment methods will incur a small card processing fee of [X%] moving forward. Here are the key details to be aware of:

Effective Date: [DATE WHEN FEE WILL START]

Card Processing Fee: [e.g 2.5%]

Payment Methods Affected: Card payments

If you are currently paying us by card, and wish to switch to Direct Debit prior to this date, please use the link below to provide and save your preferred method for future invoices.

{{ practice.name }} would like to thank you for your continued support, and if you have any questions, as always, please don’t hesitate to contact us at [CUSTOMER SUPPORT EMAIL OR PHONE NUMBER].

Kind regards,

{{ practice.name }}

If you wish to update your payment details, please go to: [CLIENT PORTAL LINK]

Introducing a new card payment method to your clients with a surcharge

If you don’t currently accept card payments but are planning to do so with a surcharge, then your communications will be quite simple. We recommend framing the change as giving your clients greater flexibility over how they pay you.

In this case we recommend that you:

- Enable surcharges in your Ignition account straight away. Ensure that the “Credit/Debit Card” option is enabled under Settings → Payments

- Optionally communicate the change to your clients via email

You can also let clients switch to a bank account payment method (ACH / Direct Debit) if they prefer. You can let clients do this themselves by including the “Payment Portal Link” in your email. To get these links export your client list and look for the “Payment Portal Link” column. Note that the link for each client is unique.

Alternatively you can use our bulk payment request feature (see section below).

Below is an email template that you can use to communicate with your clients.

Subject: Important Update: We are now accepting card payment methods 🎉

Hi {{ client.name }},

Hope you've been well!

We wanted to reach out to let you know about some upcoming changes to {{ practice name }}’s payment processes that might affect the way you make payments to us.

As of [EFFECTIVE DATE], card payment methods will incur a small card processing fee of [X%] moving forward. Here are the key details to be aware of:

Effective Date: [DATE WHEN FEE WILL START]

Card Processing Fee: [e.g 2.5%]

Payment Methods Affected: Card payments

If you are currently paying us by card, and wish to switch to Direct Debit prior to this date, please use the link below to provide and save your preferred method for future invoices.

{{ practice name }} would like to thank you for your continued support, and if you have any questions, as always, please don’t hesitate to contact us at [CUSTOMER SUPPORT EMAIL OR PHONE NUMBER].

Kind regards,

{{ practice name }}

If you wish to update your payment details, please go to: [CLIENT PORTAL LINK]

Consider allowing clients to switch to a bank account if they prefer

Once you have activated card fees, you may want to consider offering existing clients the option to switch to direct debit payments instead (if they are paying via card already)

Note: We are currently unable to apply a processing fee to bank account payments (e.g. direct debit, ACH, PAD…etc).

To do this, we suggest emailing your customer first with communications advising them of the new fee first.

Then, use Ignition’s bulk payment request feature to give them the option of entering in new bank account details to process payments via direct debit.

Example email template

To {{ client.name }},

Starting on DATE, a small processing fee will apply to card transactions.

If you’d like to avoid this fee, you can pay via bank account instead.

We will be sending you another follow up email where you can click the Update payment details button to enter your bank account details in your secure client payment portal if you wish to switch.

Note that when you enter your new payment method, we’ll use this new payment method to collect payment for all future invoices.

If you have any questions, please do not hesitate to contact us.

Sincerely,

{{ practice.admin }}

{{ practice.name }}

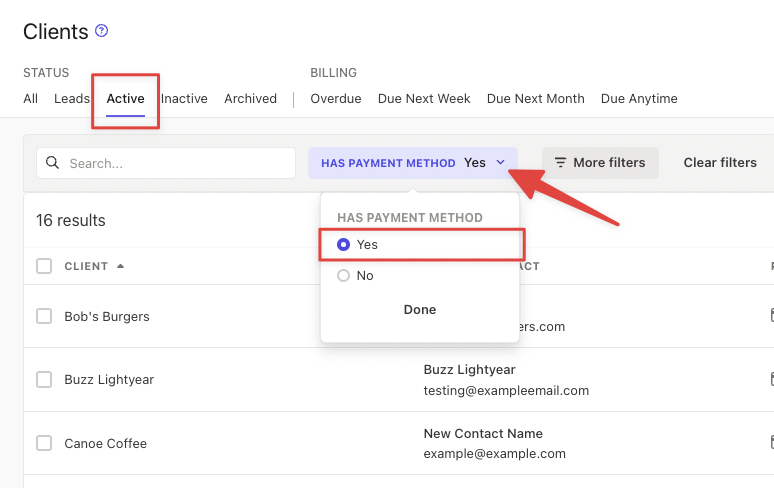

Once you have emailed your clients, navigate to your Clients tab and filter for:

- Active clients

- Have a payment method

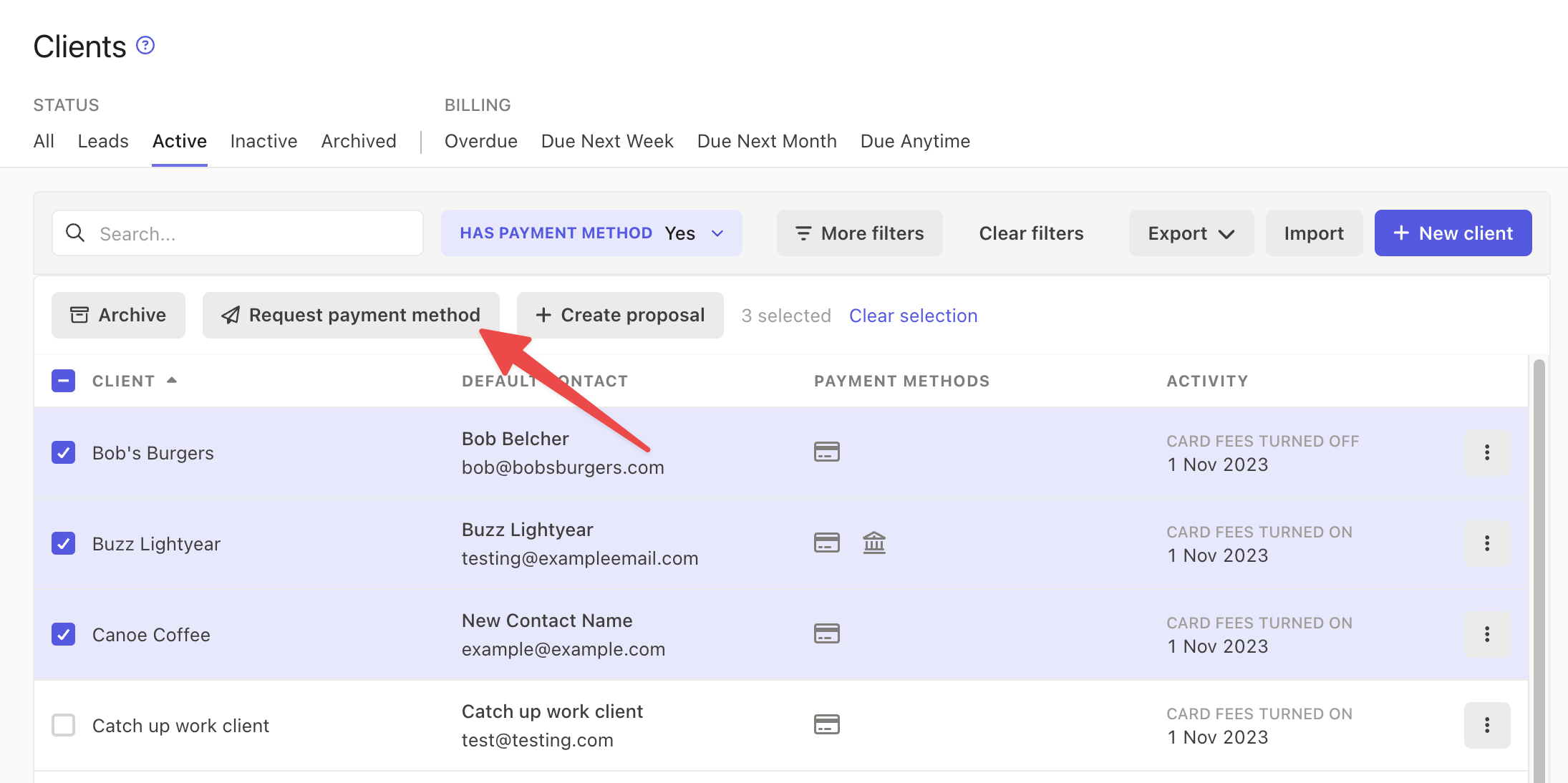

Then, select all the relevant clients and click Request payment method.

Note: We recommend only selecting clients that have an existing card payment method.

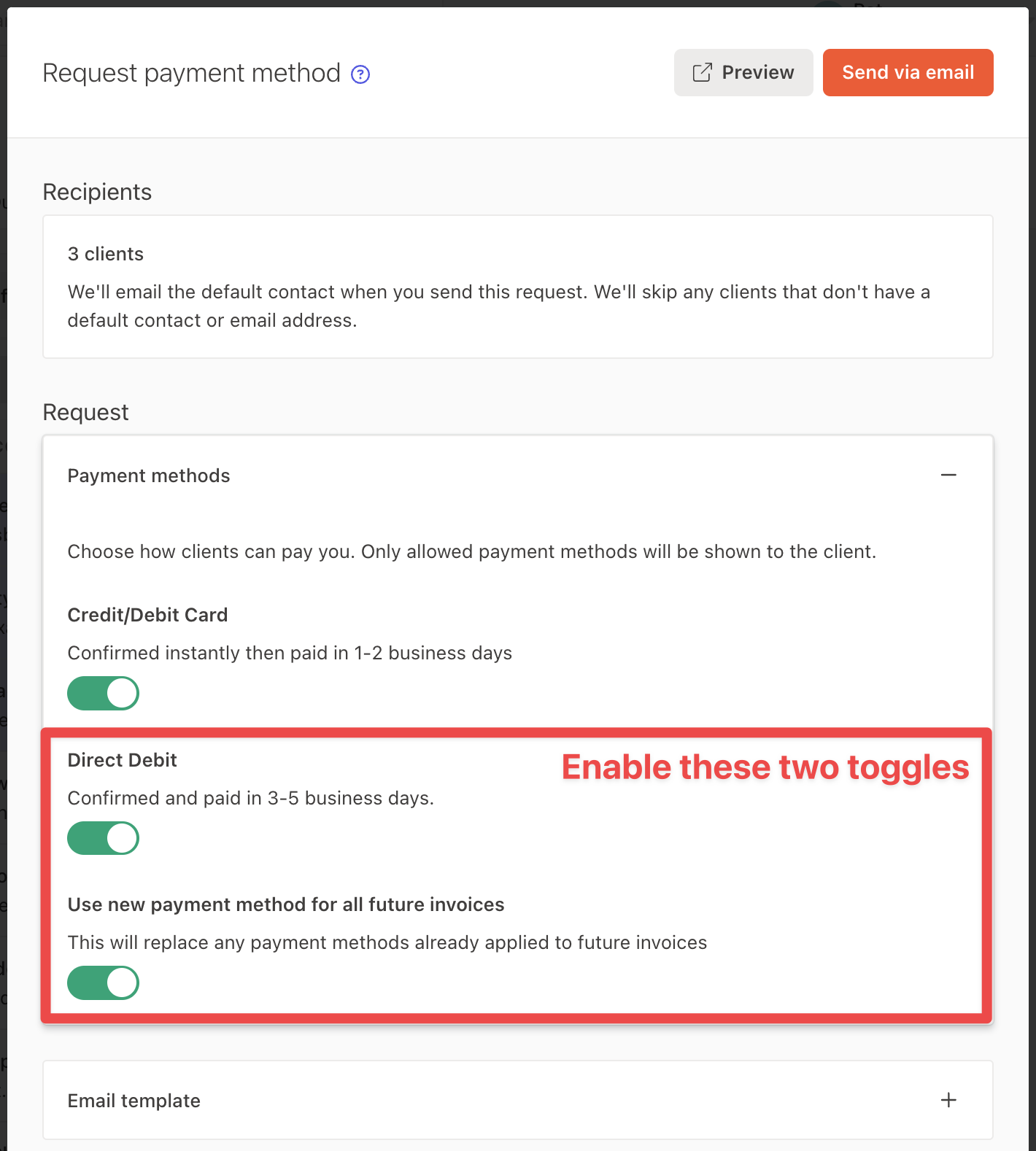

Customize the payment settings on the next screen - ensuring that you have direct debit enabled as well as “Use new payment method for all future invoices” enabled.

Next, click the Email template heading to expand it.

In here, you can include a message to your clients advising that they can enter in bank account details if they do not want to incur a fee.

Once you are ready, click Send via email to send this client payment details request in bulk to all of your chosen clients!

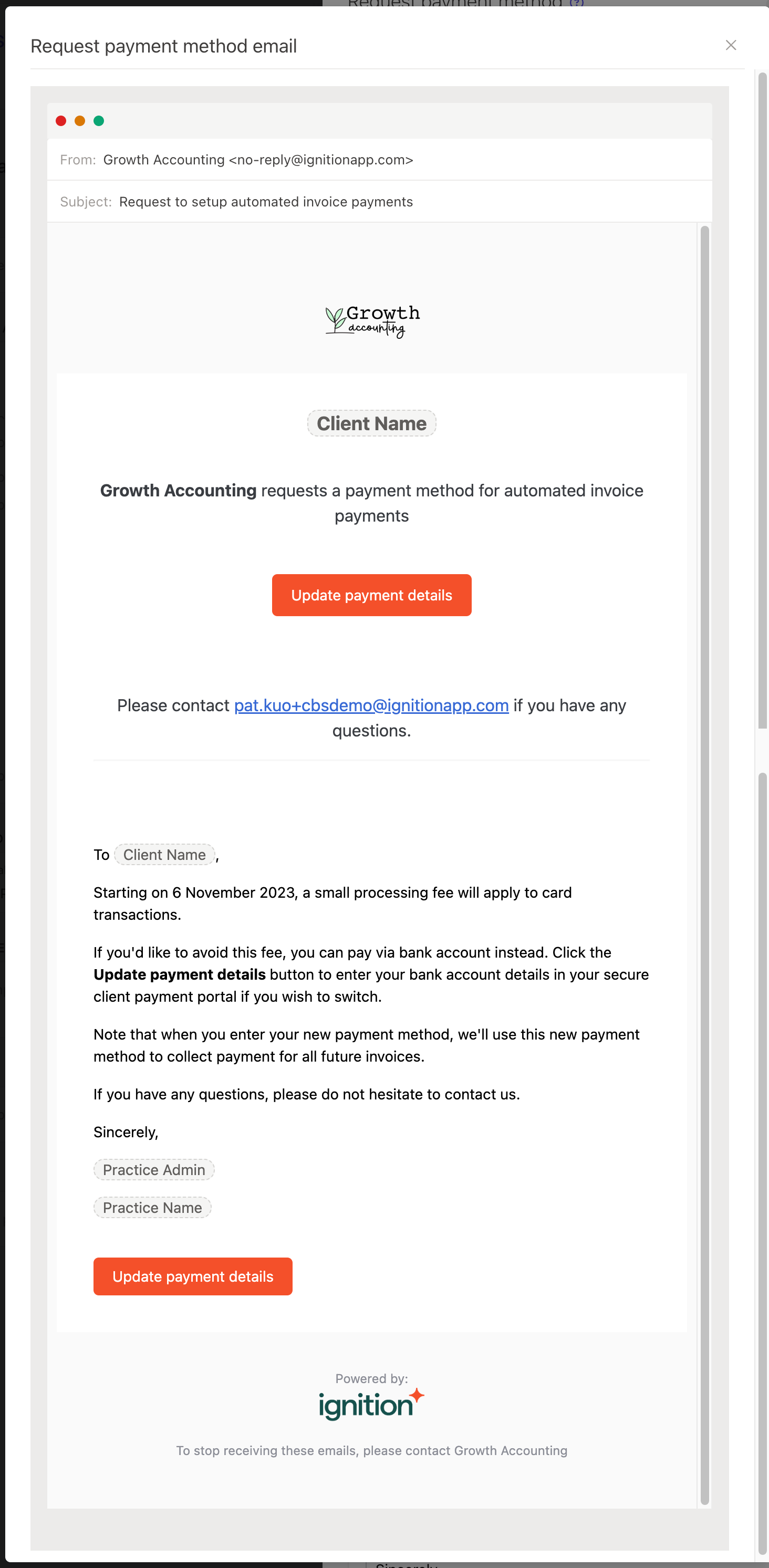

This will send to your clients like below:

You will receive email notifications whenever your clients add new payment details.

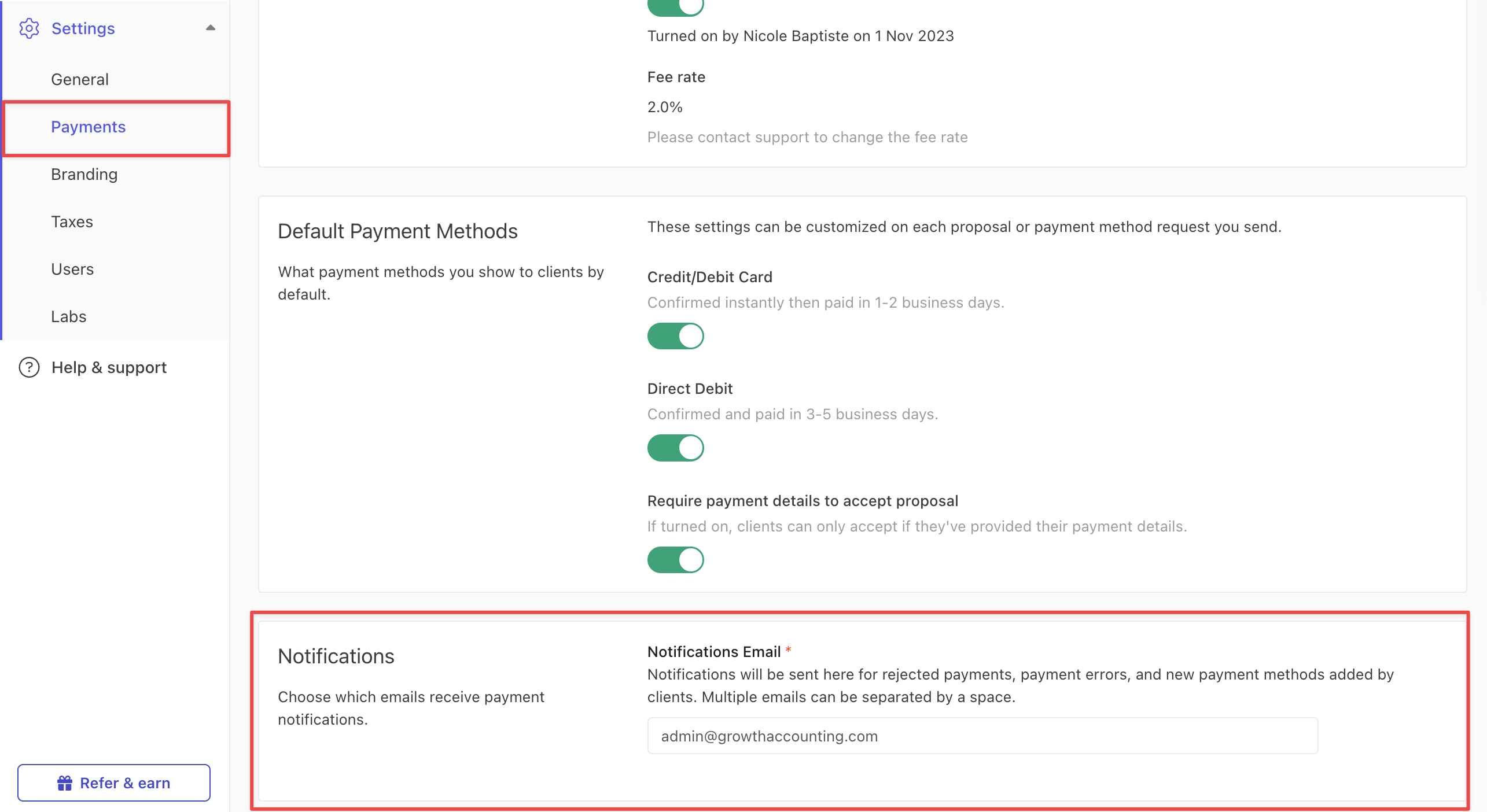

You can add or change the email address that receives these payment notifications in your Settings → Payments tab → Notifications section.

Note: Clients that are sent a request for payment details will receive 3 email reminders, with 3 days between each reminder. These reminders will stop automatically when the client provides new payment details.

A different perspective on card processing fees

This article was written to assist Ignition customers on best practices if they wish to pass on card fees to their clients.

If you are unsure whether you should pass on fees to your clients, read this article by our Head of Accounting (APAC), Becc Mihaic as she unpacks this topic with her own perspective.