Automated payment collection: 5 tips for success

Getting paid on time is crucial for keeping your business running smoothly. Without a solid system, you might find yourself covering expenses out of pocket—or worse, falling behind—putting both your finances and business relationships at risk. Not to mention, chasing down payments takes valuable time away from the work you really need to focus on.

If this element of your business has become a headache, it may be time to automate. By streamlining everything from invoicing to follow-ups, you can spend less time worrying about payments and more time delivering great service. Let’s explore five tips for success with automated payment collection.

1. Get your business and banking basics in order

Transparency is everything when establishing a pricing structure. Outline everything from service pricing and payment due dates to refund policies and penalties for late payments. By being proactive, customers understand their obligations from the beginning and billing can be done smoothly from day one.

In addition to considering your pricing structure, you need to have the right infrastructure for your business itself. This starts with making sure you’re properly incorporated and setting up a valid business bank account.

In addition to verifying your business's financial information, you must also do the same with your clients. Before proceeding with a client agreement, ensure their payment or banking details are valid so you can bill them with ease.

Proactivity is key here as well. Rather than waiting until work is completed, many successful businesses implement an upfront deposit strategy at the start of new client relationships. This practice validates both your business’s and clients’ banking details while simultaneously streamlining the final payment collection process once services are delivered.

Fortunately, this process is easy when you have the right payment processor or software, which brings us to the next tip…

2. Simplify the collection process with automated payment collection software

To run a successful firm, you need to spend as much time as possible on high-value tasks, such as:

- Acquiring new business

- Providing top-notch services

If you're an accountant, you should devote more energy to providing financial services rather than to tasks such as sending payment reminders or entering credit card numbers.

Similarly, if you’re a digital marketing agency, your time is better spent on providing services like search engine optimization (SEO) or content marketing rather than on manual invoice processing. This is why having a robust payment solution is key.

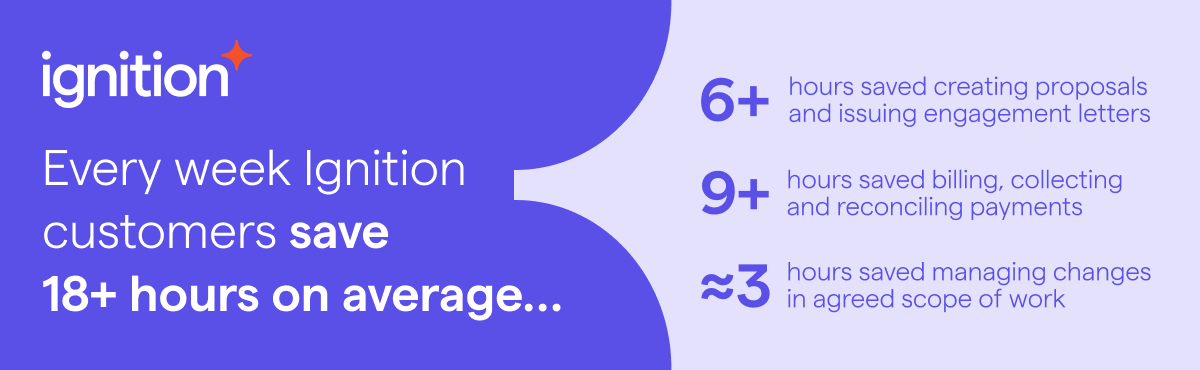

What’s the moral of the story? The amount of work involved with a manual payment system outweighs the costs involved. Automated payment collection tools like Ignition eliminate the need for manual processes, easing your administrative burden. They also reduce the risk of missed and late payments, which can improve your business’s cash flow.

Success in this arena is contingent on finding the right tool, so you should choose software that meets your business’s unique needs. For example, do you need a system that supports one-time payments, installments, or recurring payments?

It’s also important to check the software’s compatibility with your existing systems (think accounting software, enterprise resource planning (ERP) systems, and customer relationship management (CRM) tools), as well as supported payment methods. This helps ensure seamless integration.

Automate invoicing, billing, and payments with Ignition

Ignition has client payment features that allow you to collect payment details upfront and automate payment collection from the moment a client signs your proposal. When the invoice is due, the platform automatically takes the payment, so neither you nor your client has to lift a finger.

But Ignition doesn’t just automate payment processing; it also allows clients to accept proposals, e-sign them, and enter their payment information. This eliminates the need for multiple platforms, thereby improving the customer experience.

Ignition can also protect customer or client data (including their account number) to help you stay compliant and limit risk. Clients can put in their information online through a form, and that confidential data stays private. This provides both parties with more transparency, control, and trust.

Are you looking to streamline your business’s billing? Simplify and track client payments today with Ignition!

3. Follow up on late payments before they get lost in the shuffle

Even with the best planning, things can still go wrong. Clients may attach expired credit cards, decline payments, have insufficient funds in their accounts, or even dispute transactions—all of which can result in late or missed payments.

This can increase your debtors and impact your ability to finance key business operations. To eliminate or minimize the effects of such issues, follow up with clients as soon as an issue occurs.

Ignition helps prevent and manage these issues by:

- Sending invoice notifications: If you enable Invoice Notification in your General Account Settings, Ignition sends invoice emails to clients, allowing them to take appropriate measures (like updating their payment details).

- Sending payment error and rejected payment notifications: When you enter your Notifications Email, Ignition will let you know whenever payments are past due. This allows you to take swift action.

Following up and securing a missed payment with Ignition’s platform is simple. Learn more about how you can handle failed payments in Ignition in this article.

Ignition provides a breakdown of each client’s payment status, so you can track clients who don’t update their payment methods and then send reminders. You can conveniently track client payments and get payment updates from the Collections tab in your Ignition account.

4. Manage costs

Many entrepreneurs worry about accepting credit card payments, largely because of associated processing fees. These fees can range between 2.87% and 4.35% per transaction (excluding merchant service provider fees), which cuts into business income.

The good news is that there are various ways to reduce these costs. The first is to offer payment options such as automated clearing house (ACH) or direct debit—both of which are supported by Ignition. Fees will vary across payment processors, but ACH and direct debit costs are typically much lower than those of credit cards. For example, ACH costs on Stripe (Ignition’s payment processing partner) are 0.80% and capped at $5.00.

You may also be able to manage costs by passing card processing fees to customers (depending on your country or region). To do this with Ignition, simply enable the surcharge feature if applicable in your region.

5. Keep an eye on your payment reports

Having access to payment reports allows you to uncover actionable insights that can help optimize your operations and save money.

One example would be paying attention to credit cards or debit cards that are about to expire. When you have reports that automatically provide this information, you can proactively update the cards you have on file and prevent missed or default payments. Proactivity is a key client management best practice and can eliminate the need for follow-ups after payment issues occur.

This is something that Ignition does really well. The software lets the practice owner know that something's about to expire so the issue can be followed up in the proper amount of time. This allows for plenty of lead time to have the new data and credentials added by the customer.

As an added benefit, Ignition provides a visual into your sales pipeline and revenue via the Business Intelligence dashboard. This feature makes comparing your current cash flow and projected revenue easier, helping you assess your business’s financial performance.

Your Ignition dashboard also provides a revenue breakdown that can help you gauge your business’s profitability and identify your most valuable offerings. By keeping an eye on these metrics, not only can you avoid payment issues, but you can make better business decisions.

Automate invoicing and payment collection with Ignition

Payment collection automation can reduce your administrative burden and protect your cash flow, allowing you to focus on high-value tasks that grow your business. However, this is dependent on how you implement your automation strategy. For optimal results, you should pick a reliable automated payment collection tool.

With Ignition, you can say goodbye to manual, time-consuming processes that distract you from core business offerings. Our platform helps you manage payments from the moment customers accept your proposals, minimizing the risk of human error and missed payments. We also offer revenue and cash flow breakdowns for better performance assessments and business decisions.

Want to improve your payment collection process? Watch our demo to see how Ignition can help!